Montage Gold Corp. Closes Acquisition of Mankono JV from Barrick and Endeavour Exploration of High-Grade Targets Underway

November 22, 2022

Vancouver, British Columbia — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCQX: MAUTF) is pleased to announce that it has closed the acquisition of a 100% indirect interest (the “Transaction”) in the Mankono Sissédougou Joint Venture Project (“Mankono”) from subsidiaries of Barrick Gold Corporation (“Barrick”) and Endeavour Mining plc (“Endeavour”).

Montage has acquired 100% of the issued and outstanding shares of Mankono Exploration Limited (a Jersey company) (“MEL”), which indirectly holds Mankono, for total consideration of C$30,000,000 comprised of C$14,500,000 in cash, 22,142,857 common shares of Montage, and the granting of a 2% NSR royalty. Closing of the Transaction follows the receipt by Mankono of the signed Presidential decrees granting it the Gbongogo Exploration Permit (“Gbongogo”) as well as the Sisséplé Exploration Permit (“Sisséplé”).

HIGHLIGHTS

- Montage closes acquisition of Mankono

- With Mankono, consolidated Koné Gold Project (“KGP”) now covers 2,258km2

- Drilling has started on Mankono properties

- 14 drill-ready targets; 25,000m of drilling planned

- Two drill rigs mobilized to cover six initial target areas

- First assay results expected in December

- Transaction will expand the KGP

- High-grade reserves delineated following planned exploration could significantly improve KGP

- KGP economic study will be revised following exploration program

- High-Grade Gbongogo priority prospect to be drill tested

- Initial Inferred Mineral Resource of 5.2Mt at 2.1g/t for 351,000oz at 1.2g/t cut off

- Open in all directions

- 30km trucking distance from Koné deposit

- RC drilling targeting strike extensions north and south

- Initial Inferred Mineral Resource of 5.2Mt at 2.1g/t for 351,000oz at 1.2g/t cut off

- Five additional district targets being drilled

- Initial RC drilling to be completed before year-end

- Target areas include several historic high-grade intercepts, including:

- Koban North: 20m at 1.94g/t, 21m at 1.67g/t

- Lokolo Main: 20m at 2.19g/t

- Sena: 19m at 1.75g/t

- Sisséplé North anomalies improve with infill soil program

- Two anomalies, each over 1km in strike length, averaging over 100ppb

- Montage welcomes new shareholders Barrick (9.7%) and Endeavour (4.1%)

Rick Clark, Montage CEO commented, “We are very pleased to be closing the acquisition of Mankono and would like to acknowledge the efforts of Barrick and Endeavour in achieving this result and to sincerely thank the Government of Côte d’Ivoire for its support of this transaction.

With the addition of Mankono, our consolidated land position grows to more than 2,250km2 over one of the most prolific gold belts in West Africa at the centre of which is our Koné deposit. Drilling has started on our newly acquired ground looking to add higher grade resources to the Koné development plan. Based on our evaluation of the historic data from Mankono we believe that, in addition to the Inferred Mineral Resource at Gbongogo, the rest of the Mankono land package has the real potential for additional discoveries of 0.8Moz to 1.2Moz at similar grades (between 1.5-2.5g/t Au)*. We very much look forward to reporting on the progress of our aggressive exploration program, which is designed to maximize the potential of a strong economic mining operation centered on Koné.

We would also like to take this opportunity to thank our shareholders and our investors, who funded Montage in this transaction, for their patience and confidence in our team to execute what we expect will be a game changer for Montage into 2023.

Finally, we welcome the addition of Barrick and Endeavour as new shareholders and look forward to working with all our stakeholders in achieving our goals.”

* See “Conceptual Exploration Target – Mankono” at the end of this release.

DETAILS

District Consolidation

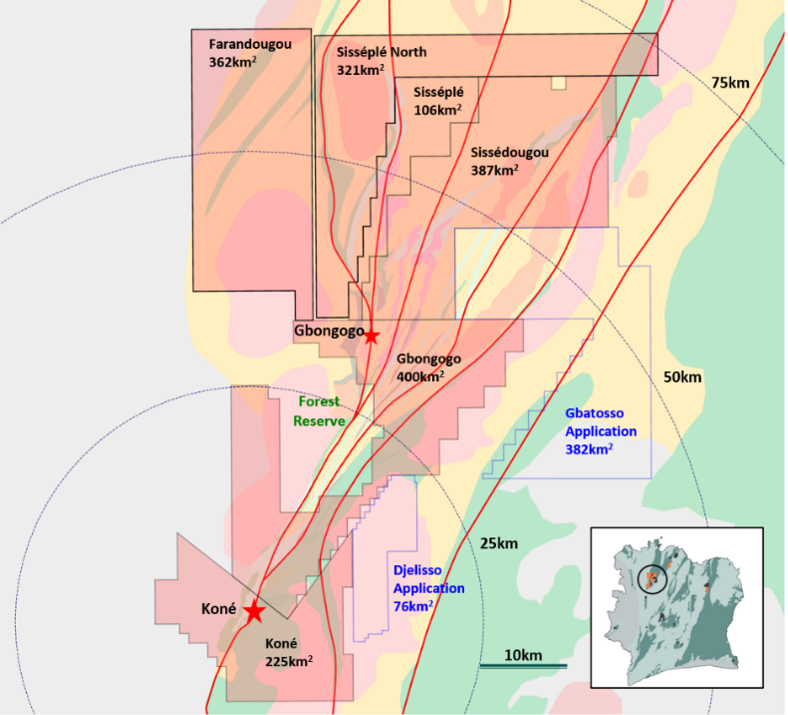

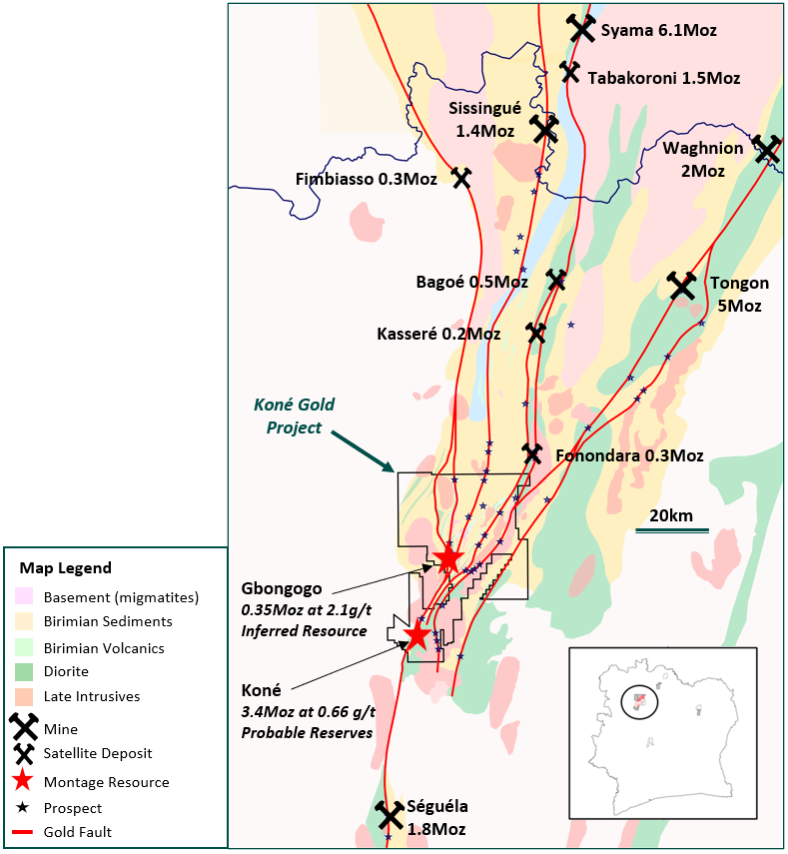

Montage’s expanded KGP (Figure 1) forms a contiguous block of 1,800km2 of exploration permits and a further 458km2 of exploration permit applications, for a total of 2,258km2. Mankono includes the Gbongogo Exploration Permit (PR919, 400km2, issued Sept 2022), the Sisséplé Exploration Permit (PR920, 106km2, issued Sept 2022) and the Sissédougou Exploration Permit (PR842, 387km2, issued July 2019). The KGP now covers a strike length of over 75km on one of the most prospective gold belts in West Africa, connecting Syama to the north with the Séguéla project in the south with over 23Moz of gold discovered to date (Figure 2).

Montage’s exploration objective is to identify high-grade satellite deposits of +50-100koz grading +1.5g/t that can be combined with the large-scale Koné deposit.

Historic exploration spending on the combined land package is approximately US$20 million which has defined over 60 strike-kilometres in soil anomalism and more than 20 targets through drilling and trenching in addition to significant artisanal mining activity in multiple areas.

Montage has spent the last four months compiling all historic work and has been on the ground for the last month in preparation for the start of drilling.

Exploration Strategy

Montage will concentrate on district exploration for the next 12 months with the primary objective of adding multiple high-grade satellite deposits to an expanded Koné Gold Project.

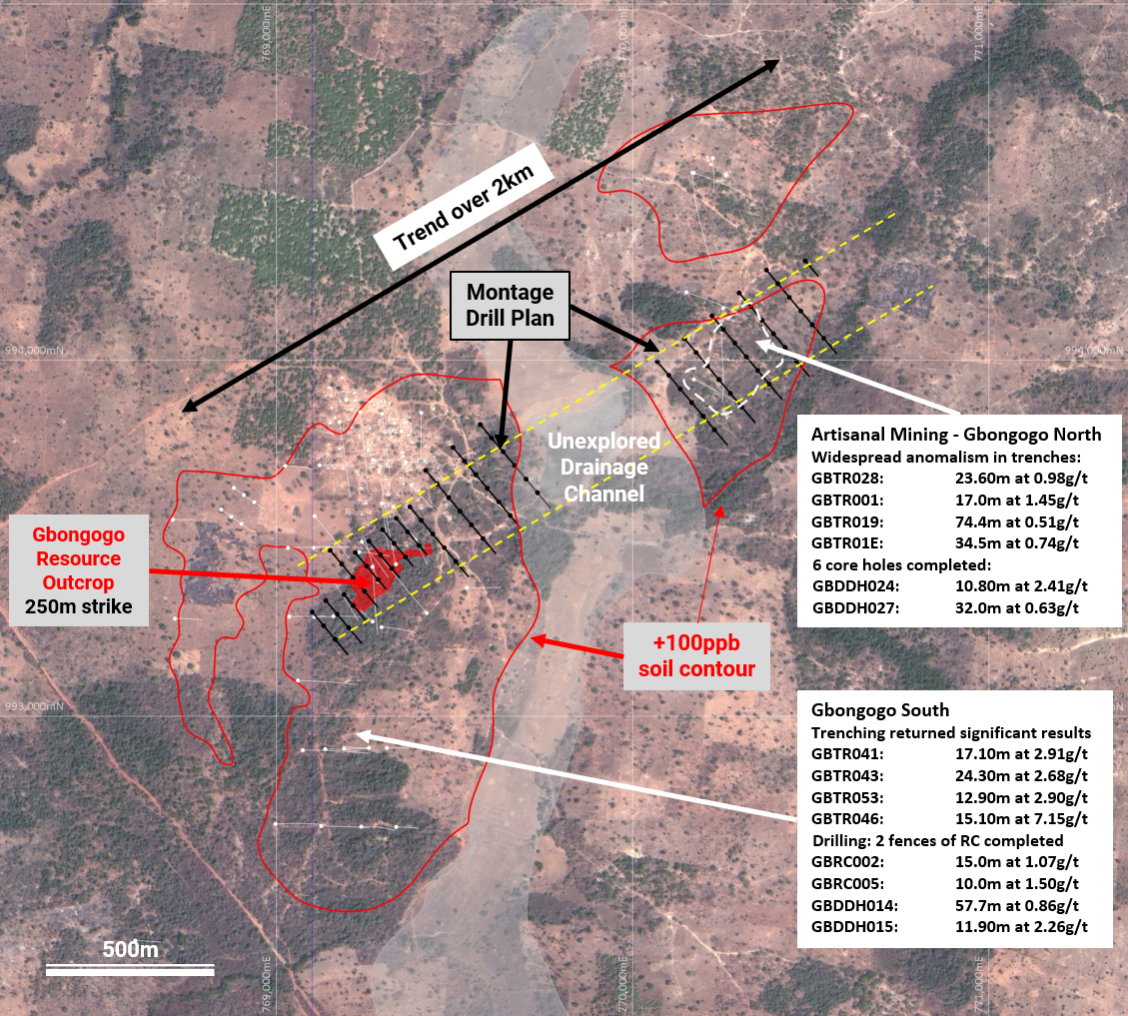

The top priority is the Gbongogo Prospect (Inferred Mineral Resource of 5.2Mt at 2.1g/t for 351koz) which has delivered intercepts of 135.2m at 2.63g/t from 1m, 92m at 2.99g/t from 33m and 77m at 2.48g/t from 61m in previous drilling. Drilling will start in the coming days targeting expansion and upgrade of this resource. Details of the previous drill results described in Figure 3 and Figure 4 are set out in Appendix 1.

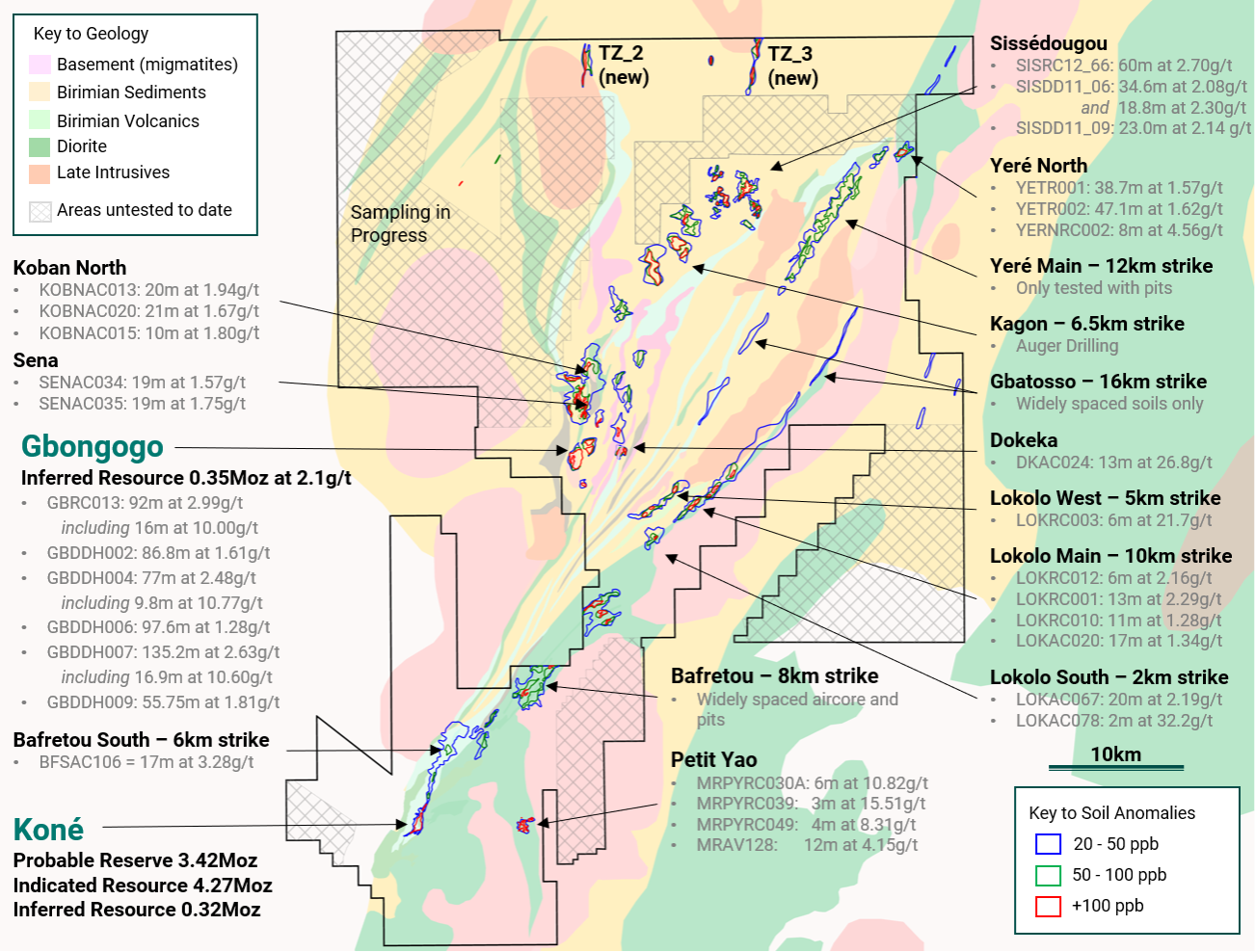

In addition to Gbongogo, there are 13 other drill-ready targets for Montage to test and numerous other areas with strong anomalism on major structures that will receive follow-up work (see Figure 3).

Montage has developed an exploration plan that will include 25,000m of drilling across a total of 11 target areas over the next seven months.

Drilling Underway

At Gbongogo, an RC rig began drilling on November 21st, and will execute a drill program designed to fully define the intrusive and targeting extension to the northeast and south (Figure 4).

Gbongogo lies 30km north of Koné and hosts an Inferred Mineral Resource of 5.2Mt grading 2.1g/t for 351koz at a 1.2g/t cut off. Mineralization at Gbongogo is hosted within and on the margins of a plunging quartz diorite plug with a surface expression of only 250m by 100m. High grades are controlled by two distinct groups of quartz-tourmaline veins with scope to develop the grade with systematic drilling.

Montage expects that Gbongogo can be upgraded and expanded quickly with the initial program of RC drilling which will then be followed by core drilling on the depth extensions in the New Year. This drilling is expected to upgrade the current inferred resource to the indicated category and provide samples for metallurgical test work so that the prospect can be incorporated into future engineering studies.

RC drilling will also target the area to the north-east where the strong soil anomaly extends and previous work and current artisanal mining shows the same alteration signature.

A second RC rig arrived on site on November 3rd (Figure 5) and will focus on first pass follow up on several district targets including Koban North, Sena, Lokolo North, Lokolo Main and Lokolo West before the Christmas break, as follows:

Koban North

RC drilling targeting an area of mineralization across 200m width not previously followed up to the north and south including 20m at 1.94g/ and 21m at 1.67g/t.

Sena

RC drilling to follow up historic results from two Aircore holes including 19m at 1.57g/t and 19m at 1.75g/t.

Lokolo Main

RC drilling to follow up historic result of 13m at 2.29g/t in an area of artisanal workings; new workings identified nearby that are untested.

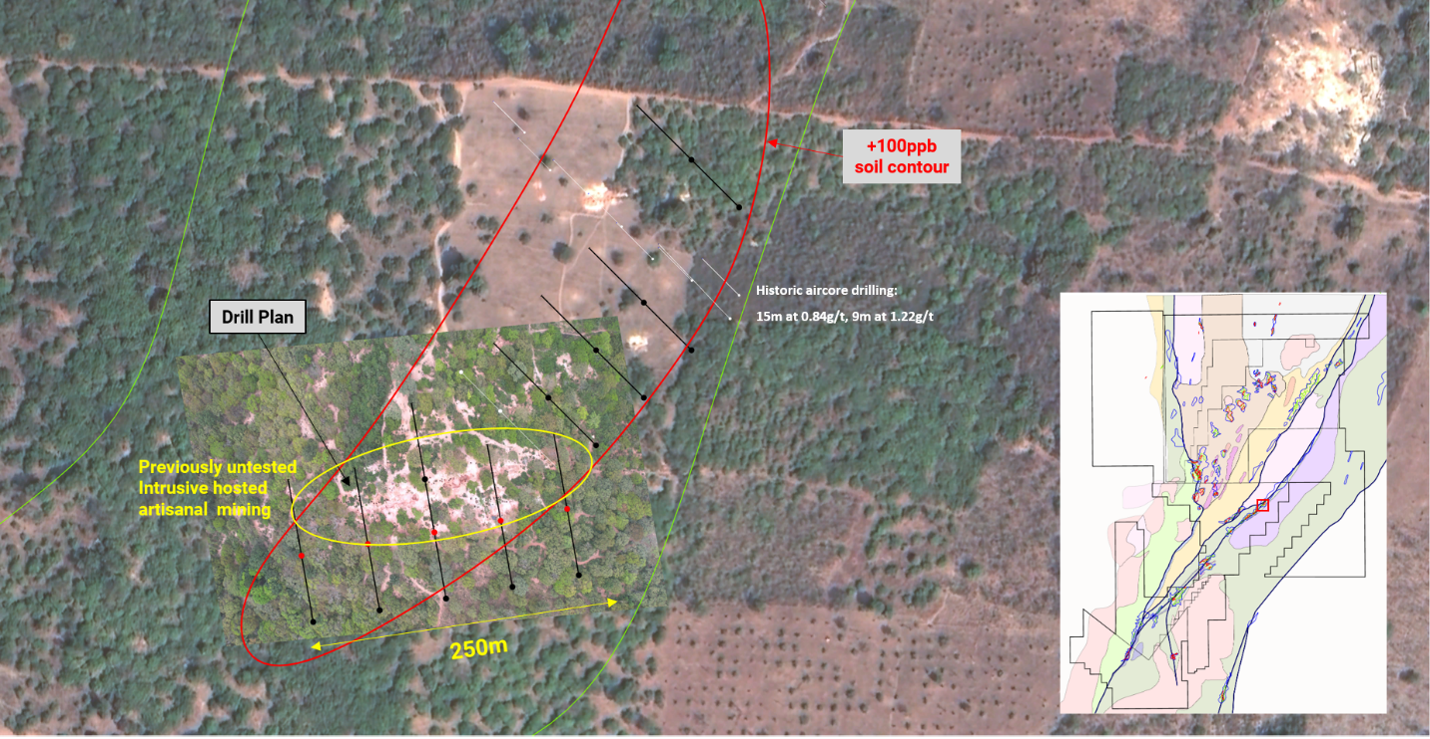

Lokolo North

RC drilling targeting a previously untested area of artisanal workings hosted by an intrusive (Figure 6).

New Discoveries Within KGP

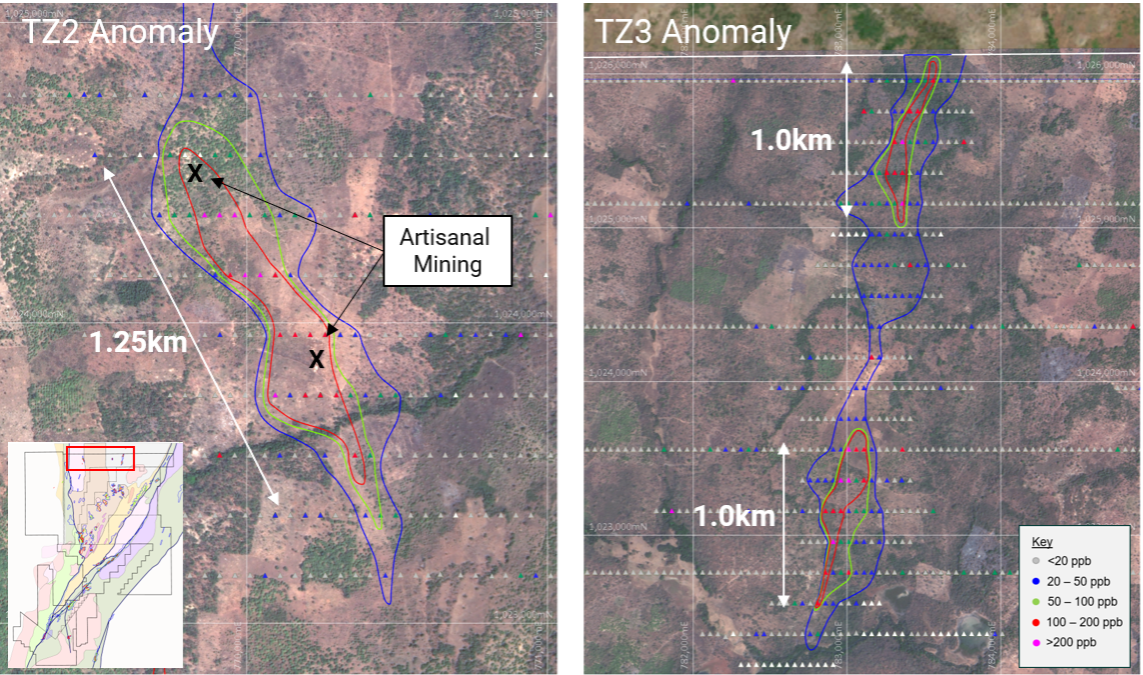

Two new, coherent, +100ppb gold anomalies have been defined and upgraded following three phases of soil sampling in the Sisséplé North Permit. In Figure 7, TZ_2 shows +100ppb anomalism over 1.25km strike and includes current artisanal mining areas. TZ_3 shows +100ppb anomalism over two separate areas of 1.0km in strike. Both anomalies will be targeted with aircore drilling in early 2023 to further develop the targets.

Samples used for the results described above have been prepared and analyzed by fire assay using a 50-gram charge at the Bureau Veritas facility in Abidjan, Côte d’Ivoire. Field duplicate samples are taken, and blanks and standards are added to every batch submitted. QAQC and interpretations have been reviewed by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to NI 43-101.

Completion of Mankono Acquisition

Pursuant to the share purchase agreement (the “Agreement”) signed by Montage with Barrick and Endeavour, Montage has acquired 100% of the outstanding shares of MEL in exchange for total consideration (the “Consideration”) of C$30,000,000, consisting of C$14,500,000 in cash and 22,142,857 common shares of Montage (priced at C$0.70 per common share), plus a 2% NSR royalty on Mankono. The Consideration has been split pro-rata on a 70/30 basis between Barrick and Endeavour.

In connection with the Transaction, Montage completed a C$20.0M financing through the sale of 28,571,429 Subscription Receipts at a price of C$0.70 per Subscription Receipt (the “Offering”). Concurrent with the closing of the Transaction, the proceeds from the Offering have been released from escrow and the Subscription Receipts have been exchanged on a 1:1 basis for common shares of Montage. Montage has received net proceeds of approximately C$5.2M from the Offering, after deducting all commissions, legal and TSXV fees associated with the Offering, interest charges and the cash consideration paid to Barrick and Endeavour. The Offering was led by Stifel GMP, as lead underwriter, on behalf of a syndicate of underwriters including Beacon Securities Limited, BMO Capital Markets, and Raymond James Ltd.

Montage currently has 160,504,290 issued and outstanding common shares, 4,800,000 stock options outstanding and a cash balance of approximately C$8.2M.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project, located in northwest Côte d’Ivoire, covering a total area of 2,258km2 and which currently hosts a Probable Mineral Reserve of 161.1Mt grading 0.66g/t for 3.42M ounces of gold. The Company released the results of a DFS on the Koné Gold Project on February 14, 2022, outlining a 15-year gold project producing an estimated 3.06M ounces of gold over life of mine, with average annual production of 207koz, and estimated peak production of 320koz. The project also contains an Inferred Mineral Resource of 5.2Mt at 2.1g/t for 351,000oz at 1.2g/t cut off at the Gbongogo Prospect located 30km north of the Koné deposit. Montage is executing an exploration program in 2022/23 with the objective of discovering multiple high-grade satellite deposits to supplement the Probable Reserves at the Koné Gold Project. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa.

CONCEPTUAL EXPLORATION TARGET – MANKONO

The potential quantity and grade are presently conceptual in nature, and there has been insufficient exploration to define such a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The potential quantity and grade were developed based on a review of available historic data, grade, intersected widths, and possible strike extent at the various prospects and the overall prospectivity of the land package.

TECHNICAL DISCLOSURE – GBONGOGO

The Mineral Resource Estimate for Gbongogo has an effective date of Aprill 22, 2022, and was carried out by Mr. Jonathon Abbott of MPR Geological Consultants of Perth, Western Australia who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101 (“NI 43-101”). Mr. Abbott consents to the inclusion in this press release of the information, in the form and context in which it appears. For details regarding data verification, QA/QC, interpretations, details regarding drill results and the assumptions, parameters and related matters with respect to the Inferred Mineral Resource Estimate, please see the press release titled “Montage Gold Corp. Announces Government Approval of Mankono Exploration Permits and Provides Corporate Updates” dated September 8, 2022 and filed on the Company’s SEDAR profile at www.sedar.com.

TECHNICAL DISCLOSURE – KONÉ GOLD PROJECT

The Mineral Reserve Estimate for the Koné Gold Project has an effective date of February 14, 2022 and was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd. who is considered to be independent of Montage. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43-101.

The Mineral Resource Estimates for the Koné Gold Project have an effective date of August 12, 2021 and were carried out by Mr. Jonathon Abbott of MPR who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43-101.

For further details of the data verification undertaken, exploration undertaken and associated QA/QC programs, and the interpretation thereof, and the assumptions, parameters and methods used to develop the Mineral Reserve Estimate and the Mineral Resource Estimates for the Koné Gold Project, please see the definitive feasibility study, entitled "Koné Gold Project, Côte d'Ivoire Definitive Feasibility Study National Instrument 43-101 Technical Report" (the “DFS”) and filed on SEDAR at www.sedar.com. The DFS was prepared by Lycopodium Minerals Pty Ltd. and incorporates the work of Lycopodium and Specialist Consultants, including Mr. Abbott, under the supervision of Sandy Hunter, MAusIMM(CP), of Lycopodium, a Qualified Person pursuant to NI 43-101 who is independent of Montage. Readers are encouraged to read the DFS in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The DFS is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical contents of this press release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mr. Stuart is the President of the Company, a Chartered Geologist and a Fellow of the Geological Society of London.

CONTACT INFORMATION

Hugh Stuart

President

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company’s resource properties and resource estimates, and the Company’s plans, focus and objectives, including its exploration objectives and future exploration programs at Mankono and districtwide at the KGP, expectations that the Gbongogo Inferred Mineral Resource will become an Indicated Mineral Resource, expectations that the KGP will be improved and that additional higher grade resources will be added, the details regarding the conceptual exploration target for Mankono, and timing for an updated technical report on the KGP. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions, including, with respect to mineral resource estimates, those set out in the DFS and those set out under the heading “Mineral Resource Modeling and Estimation Assumptions – Gbongogo” in the press release titled “Montage Gold Corp. Announces Government Approval of Mankono Exploration Permits and Provides Corporate Updates” dated September 8, 2022 and filed on the Company’s SEDAR profile at www.sedar.com. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to gold and other commodity prices, including lower than expected future gold prices which could reduce the economic returns on, or the viability of, a deposit, uncertainties inherent in the exploration of mineral properties such as incorrect resource estimates due to incorrect modelling or unforeseen geological conditions, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s annual information form under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

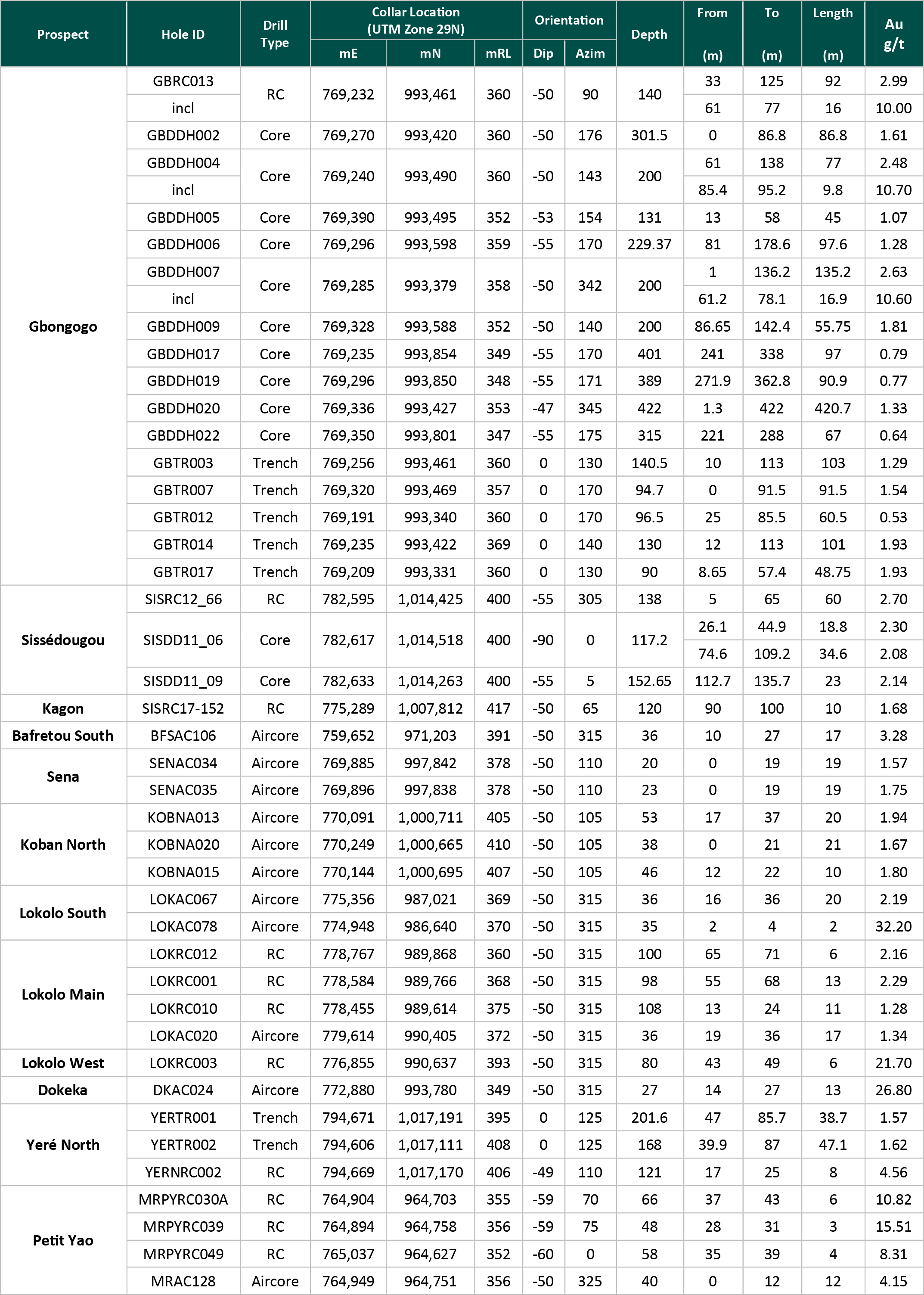

Appendix 1: Listing of Intercept Detail