Montage Announces Government Approval of Mankono Exploration Permits and Provides Corporate Updates

September 8, 2022

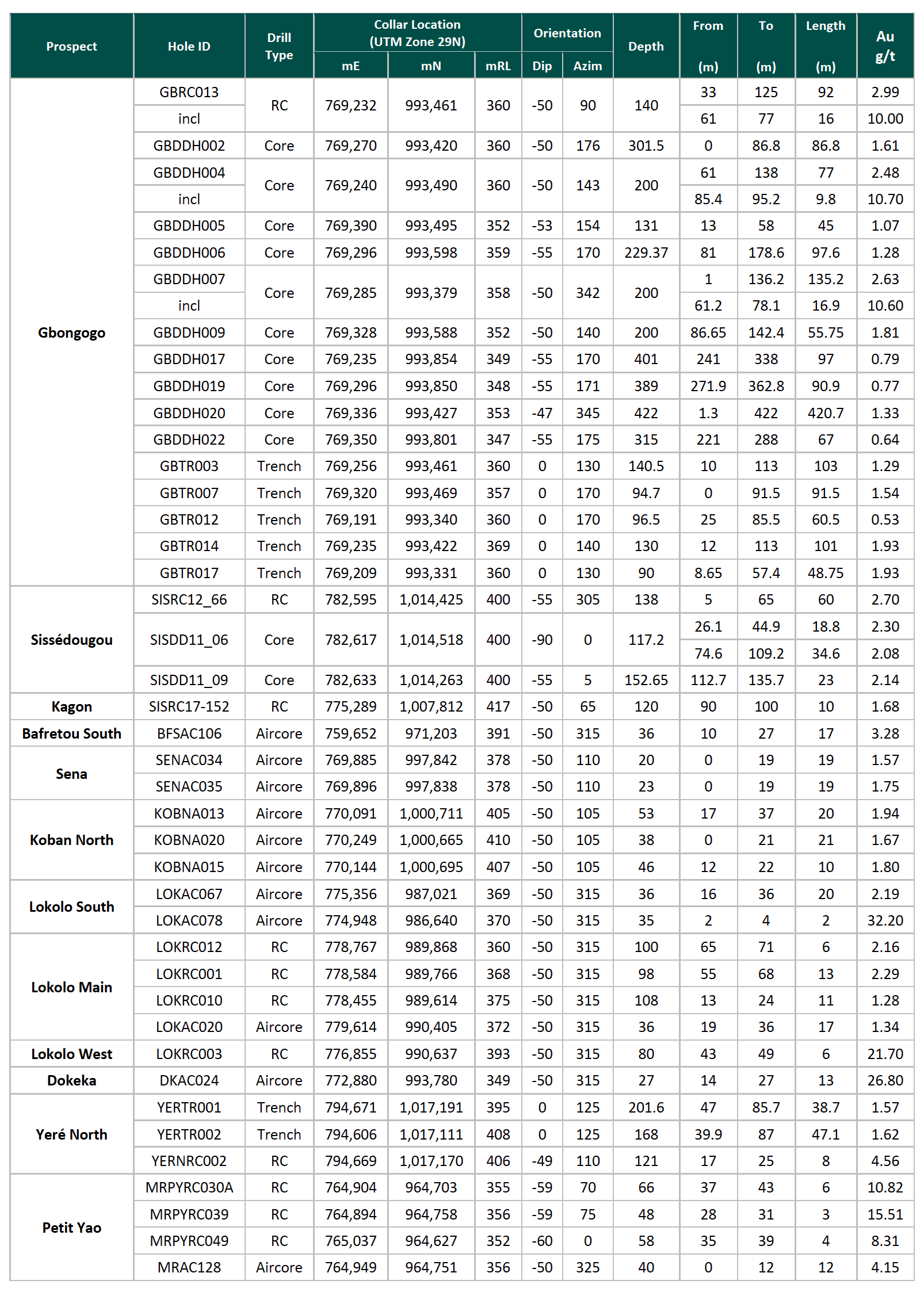

Vancouver, British Columbia — September 8, 2022 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCPK: MAUTF) is pleased to announce that on September 6, 2022, the Ivorian Council of Ministers approved the award of the Gbongogo and Sisséplé Exploration Permits to the Mankono-Sissédougou Joint Venture (“Mankono”). Public disclosure of these awards can be viewed at the following url: https://rti.info/politique/13686. This marks a critical step in the process towards closing of the previously announced acquisition of Mankono by Montage (the “Transaction”, see press release dated June 8, 2022, for more details). Montage expects to close the Transaction in the coming weeks, following receipt of the signed Presidential decree in respect of the Gbongogo Exploration Permit. With the granting of the Mankono permits now approved, Montage is pleased to provide disclosure of the extensive historic database of results from Mankono for the first time, as well as details of the Company’s exploration plans and strategy.

HIGHLIGHTS

- Mankono exploration permits approved by Government of CDI

- Transaction to close following receipt of signed Presidential decree; expected in coming weeks

- 14 drill-ready targets; initial 25,000m of drilling planned

- Drill rig mobilization by end of September

- 65km strike length of soil anomalism

- US$20M in historic exploration with large database

- Transaction will expand Koné Gold Project (“KGP”)

- High-grade reserves delineated following further exploration could significantly improve KGP

- KGP economic study will be revised following aggressive exploration program

- Gbongogo prospect gives high-grade head start 30km from Koné deposit

- Numerous significant intercepts, including:

- 135.2m at 2.63g/t from 1m

- 92m at 2.99g/t from 33m

- 77m at 2.48g/t from 61m

- Initial Inferred Mineral Resource of 5.2Mt at 2.1g/t for 351,000oz at 1.2g/t cut off

- Open in all directions

- Numerous significant intercepts, including:

- Other top priority targets with high-grade drill results, include:

- Sissédougou: 60m at 2.63g/t

- Bafretou South: 17m at 3.28g/t on strike 6km from Koné deposit

- Dokeka: 13m at 26.80g/t

- Lokolo South: 2m at 32.20g/t

- Lokolo Main: 20m at 2.19g/t

- Koban North: 20m at 1.94g/t

Rick Clark, Montage CEO commented,

“We are very pleased to have received notice of the approval of the Mankono exploration permits and look forward to closing the Transaction with Barrick and Endeavour upon receipt of the Presidential decree. We very much appreciate the support of the Government of Côte d’Ivoire towards accomplishing this.

"With the addition of Mankono, our consolidated land position grows to more than 2,250km2 over one of the most prolific gold belts in West Africa, all of which is within haulage distance of the expanded Koné Gold Project. We intend to explore aggressively to prove up multiple satellite targets and the high-grade Gbongogo deposit which remains open in all directions gives us an excellent head start. Based on our evaluation of the historic data we believe that, in addition to the initial Inferred Mineral Resource at Gbongogo, the Mankono package has real potential for further discoveries of 0.8Moz to 1.2Moz at a grade of between 1.5g/t and 2.0g/t*. Given the average mineral reserve grade of the Koné deposit of 0.66g/t, the addition of higher grade reserves from Mankono could significantly improve the economics of the KGP going forward.”

*This potential quantity and grade are presently conceptual in nature, and there has been insufficient exploration to define such a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The potential quantity and grade were developed based on a review of available historic data, grade, intersected widths, and possible strike extent at the various prospects and the overall prospectivity of the land package.

DETAILS

Overview of Mankono-Sissédougou Joint Venture Project

Mankono consists of the Sissédougou Exploration Permit (PR842, 387km2) issued in 2019, the Gbongogo Exploration Permit (400km2) and the Sisséplé Exploration Permit (106km2) which are all contiguous with Montage’s Koné Gold Project as shown in Figure 1. Taken together with Montage’s existing land holdings they form a block of 1,800km2 in exploration permits and a further 458km2 in exploration permit applications for a total of 2,258km2.

The Gbongogo area has been explored by Randgold (Barrick) since 2013 and the Sissédougou and Sisséplé areas by Endeavour and previously La Mancha Resources since 2010. The Mankono Joint Venture was formed in 2017 and exploration has been managed by Barrick since that time.

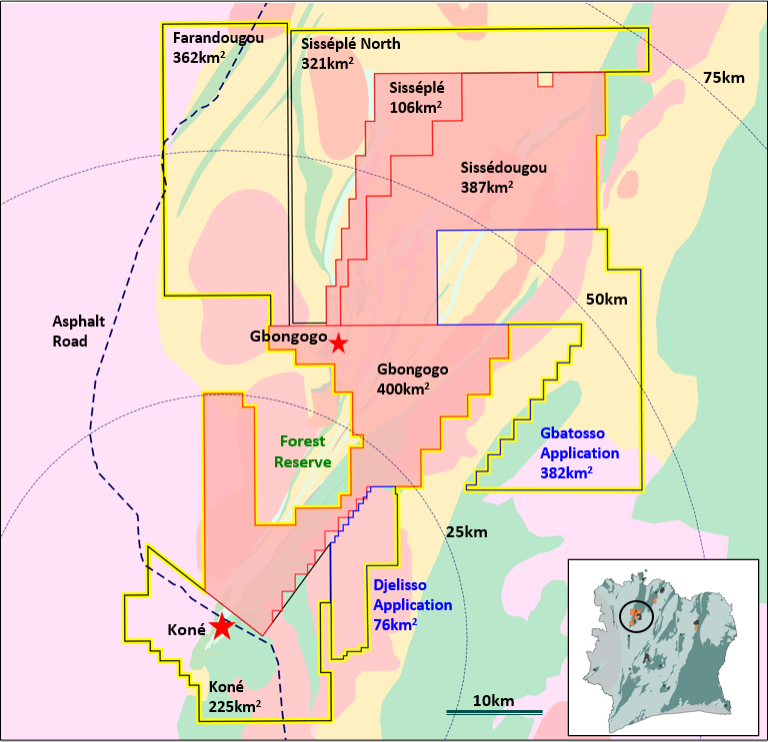

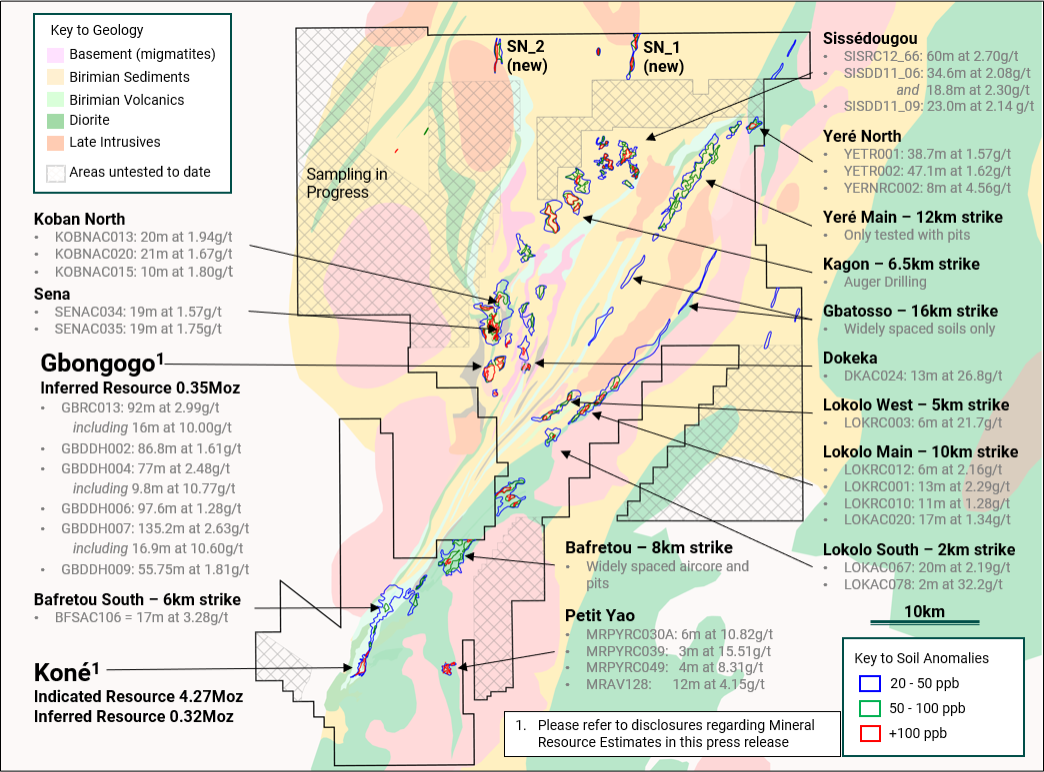

The database of the historic work includes over 36,000 soil samples, 15,500m of trenching and 31,000m of air core drilling. Notably only 6,000m of Reverse circulation (“RC”) drilling and 8,560m of diamond core drilling has been completed most of which is on the Gbongogo prospect. Historic exploration spending on the combined land package is approximately US$20 million. Figure 2 shows the consolidated land package with target areas and highlighted results.

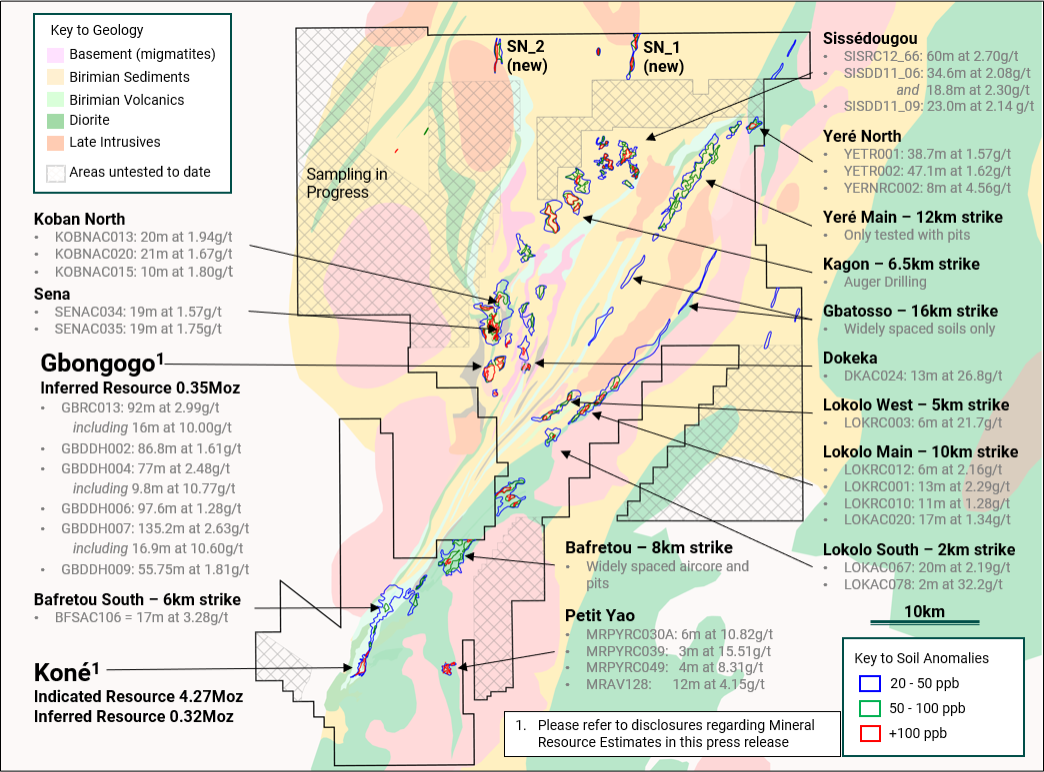

Gbongogo Prospect – Immediate High-Grade Impact

The Gbongogo prospect, which lies 30km north of Koné, hosts an initial Inferred Mineral Resource of 5.2Mt grading 2.1g/t for 351koz and is the primary target for resource expansion and upgrade. Montage expects that this prospect can be expanded quickly and has an initial program of 4,000m planned in pursuit of this objective. Mineralization at Gbongogo is hosted within and on the margins of a plunging quartz diorite plug with a surface expression of only 250m by 100m (see Figure 4). Table 1 shows intercepts from historic drilling and trenching results. Complete results are presented in Appendix 1 to this release.

Table 1 – Drill and Trench Results from Gbongogo

| Hole | From (m) |

To (m) |

Length (m) |

Au g/t |

Comments |

| GBRC013 | 33 | 125 | 92 | 2.99 | Including 16m at 10.0g/t from 61m |

| GBDDH002 | 0 | 86.8 | 86.8 | 1.61 | |

| GBDDH004 | 61 | 138 | 77.0 | 2.48 | Including 9.8m at 10.7g/t from 85.4m |

| GBDDH005 | 13 | 58 | 45.0 | 1.07 | |

| GBDDH006 | 81 | 178.6 | 97.6 | 1.28 | |

| GBDDH007 | 1 | 136.2 | 135.2 | 2.63 | Including 16.9m at 10.6g/t from 61.2m. Down plunge hole |

| GBDDH009 | 86.65 | 142.4 | 55.75 | 1.81 | |

| GBDDH017 | 241 | 338 | 97.0 | 0.79 | |

| GBDDH019 | 271.9 | 362.8 | 90.9 | 0.77 | |

| GBDDH022 | 221 | 288 | 67.0 | 0.64 | |

| GBDDH020 | 1.3 | 422 | 420.7 | 1.33 | Down plunge hole (ends in mineralization) |

| GBTR012 | 25 | 85.5 | 60.5 | 0.53 | Trench |

| GBTR017 | 8.65 | 57.4 | 48.75 | 1.93 | Trench |

| GBTR014 | 12 | 113 | 101 | 1.93 | Trench |

| GBTR003 | 10 | 113 | 103 | 1.29 | Trench |

| GBTR007 | 0 | 91.5 | 91.5 | 1.54 | Trench |

Note: True widths vary between 60 and 100% of downhole intercepts with exception of down plunge holes. Intercepts for holes GBDDH002, GBDDH007 and GBDDH020 include un-assayed gaps, which have been assigned the average intercept grade.

High grades are controlled by two distinct groups of quartz-tourmaline veins with scope to develop the grade with well placed drilling. The plunging quartz diorite plug is also yet to be fully defined by drilling. Furthermore, given the small surface expression there is the potential for other similar intrusive bodies to be present within the north-south trend that hosts Gbongogo that could have been missed on widely spaced first pass exploration and it will be a priority to follow up in this area.

Initial Inferred Mineral Resource Estimate

Montage commissioned a Mineral Resource Estimate (“MRE”) by MPR Geological Consultants of Perth, Australia (“MPR”) based on the historic drill database. MPR estimated recoverable mineral resources using Multiple Indicator Kriging (“MIK”) based on a dataset that includes 6,142.4m drilling (4,827.4m of diamond core and 1,315m of RC).

The Inferred MRE is reported within an optimized pit shell based on a US$1,500/oz gold price and is shown below at a range of cut-off grades. A cut-off grade of 1.2g/t is the base case scenario.

Table 2 – Inferred Mineral Resource Estimate by Cut-off Grade

| Cut-off Grade | Inferred | ||

| Au g/t | Mt | Au g/t | Au Koz |

| 0.20 | 20 | 0.97 | 624 |

| 0.35 | 16 | 1.1 | 566 |

| 0.40 | 15 | 1.2 | 579 |

| 0.60 | 11 | 1.4 | 495 |

| 0.80 | 8.8 | 1.6 | 453 |

| 1.00 | 6.7 | 1.8 | 388 |

| 1.20 | 5.2 | 2.1 | 351 |

| 1.40 | 4.1 | 2.3 | 303 |

Notes:

- Inferred Mineral Resources are reported in accordance with NI 43-101 with an effective date of the 22nd of April 2022, for the Gbongogo deposit within the Koné Gold Project. The Inferred MRE was prepared by Mr. Jonathan Abbott of MPR Geological Consultants of Perth, Australia who is a Qualified Person as defined by NI 43-101.

- The inferred MRE is reported on a 100% basis and is constrained within an optimal pit shell generated at a gold price of US$1,500/ounce.

- The Mineral Resources are classified according to the “CIM” definition of Inferred Mineral Resources.

- The estimates at 1.2g/t cut-off grade represent the base case or preferred scenario.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Also see “Mineral Resource Modeling and Estimation Assumptions – Gbongogo”.

Additional Target Areas

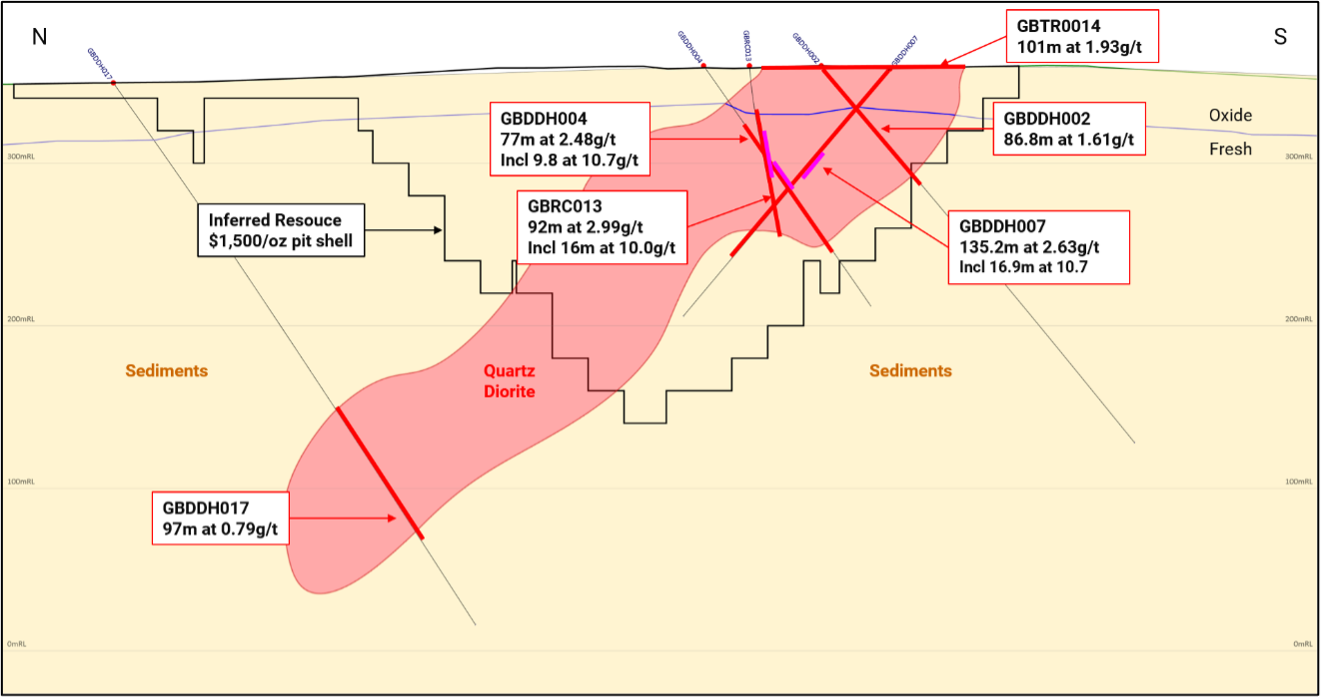

Soil sampling across the Mankono project area has defined more than 65km of soil anomalism (see Figure 2). Follow up exploration in the form of pitting, trenching and aircore drilling was widely spaced due to the nature of the desired target size but has identified a total of twelve targets, in addition to Gbongogo, where drilling has intersected mineralization with width and grade (see Table 3). These represent immediate drill targets where Montage will move quickly to drilling.

Table 3 – Highlight Drill and Exploration Results from Mankono Prospects (excluding Gbongogo)

| Target | Hole ID (m) |

Drill Type (m) |

From (m) |

To m g/t |

Length | Au g/t |

| Sissédougou | SISRC12_66 | RC | 5 | 65 | 60 | 2.70 |

| SISDD11_06 | Core | 26.1 | 44.9 | 18.8 | 2.30 | |

| 74.6 | 109.2 | 34 | 2.08 | |||

| SISDD11_09 | Core | 112.7 | 135.7 | 23 | 2.14 | |

| Kagon | SISRC17-152 | RC | 90 | 100 | 10 | 1.68 |

| Bafretou South | BFSAC106 | Aircore | 10 | 27 | 17 | 3.28 |

| Sena | SENAC034 | Aircore | 0 | 19 | 19 | 1.57 |

| SENAC035 | Aircore | 0 | 19 | 19 | 1.75 | |

| Koban North | KOBNA013 | Aircore | 17 | 37 | 20 | 1.94 |

| KOBNA020 | Aircore | 0 | 21 | 21 | 1.67 | |

| KOBNA015 | Aircore | 12 | 22 | 10 | 1.80 | |

| Lokolo South | LOKAC067 | Aircore | 16 | 36 | 20 | 2.19 |

| LOKAC078 | Aircore | 2 | 4 | 2 | 32.20 | |

| Lokolo Main | LOKRC012 | RC | 65 | 71 | 6 | 2.16 |

| LOKRC001 | RC | 55 | 68 | 13 | 2.29 | |

| LOKRC010 | RC | 13 | 24 | 11 | 1.28 | |

| LOKAC020 | Aircore | 19 | 36 | 17 | 1.34 | |

| Lokolo West | LOKRC003 | RC | 43 | 49 | 6 | 21.70 |

| Dokeka | DKAC024 | Aircore | 14 | 27 | 13 | 26.80 |

| Yeré North | YERTR001 | Trench | 47 | 85.7 | 38.7 | 1.57 |

| YERTR002 | Trench | 39.9 | 87 | 47.1 | 1.62 | |

| YERNRC002 | RC | 17 | 25 | 8 | 4.56 |

Note: Insufficient data is available at this time to determine true widths for reported intercepts. See Appendix 1 for table of complete results.

Apart from the targets that have already received drill testing, the soil anomalies clearly map out the mineralized structures and these will be followed up in detail. Most notably:

- Northern strike extension of Koné soil anomaly

- Soil anomaly extends 6km north of Koné deposit

- Historic work tested the anomaly using aircore traverses spaced 500-900m apart

- Yeré main 12km strike length soil anomaly

- Anomaly has been tested with widely spaced lines of pits but lies in an area of complex regolith

- Kagon soil anomaly

- Large soil anomaly with significant areas of over 100ppb gold in soils

- Has only been partially tested by mechanized auger

STRATEGIC PLAN

Montage is concentrated on district exploration for the next 12 months. The primary objective being to add multiple high-grade satellite deposits to an expanded Koné Gold Project. A summary of the Company’s operational strategy is as follows:

Exploration Programs

- Gbongogo Exploration Permit(400km2; part of Mankono acquisition)

- Resource expansion drilling at Gbongogo prospect

- Initial program of 3,000m of RC and 1,000m of core

- Includes geotechnical, hydrological drilling and samples for metallurgical testing

- Follow-up of anomalism and prior drill results at Bafretou, Dokeka and Lokolo targets

- 5,000m to 10,000m of aircore

- Resource expansion drilling at Gbongogo prospect

- Sissédougou Exploration Permit (387km2; part of Mankono acquisition)

- Initial follow-up of priority targets that suggest resource potential

- Targets: Sissédougou, Koban North, Yeré, and Sena

- 3,000m of RC drilling planned with 5,000m to 10,000m of aircore

- Soil sampling of untested areas

- Sisséplé North Permit (321km2; existing KGP)

- New permit recently awarded to Montage

- Local operating base has been established that will facilitate exploration in northern portion of expanded project area

- Soil sampling program on an 800m by 50m grid targeting the entire permit in progress

- Two new +100ppb anomalies >2km strike defined and being followed up

- Koné Exploration Permit (225km2; existing KGP)

- 5,000m of aircore drilling to test strike extension at Petit Yao

- 3,000m to 5,000m of RC to define resource

- 5,000m of aircore drilling to test strike extension at Petit Yao

Environmental & Social Impact Assessment (“ESIA”) and Economic Analysis

The Company continues to engage with various government ministries regarding key aspects of the project and which will form a significant component of the ESIA review and validation process. As part of the planned programs in Mankono the Company will commence baseline environmental studies and expand its successful CSR program to the wider project area. In parallel with exploration, Montage will undertake the necessary test work and engineering studies to incorporate Gbongogo and other new potential deposits into a revised economic study on the KGP in 2023.

Other Corporate Updates

The Company is pleased to announce that its common shares began trading as of September 1, 2022 on the OTCQX Best Market under the ticker symbol MAUTF, which is an upgrade from the OTC Pink Sheets where Montage previously traded. Montage will continue to trade on the TSX Venture Exchange as its primary listing under the symbol MAU.

The Company also announces that shareholders approved certain amendments to the incentive stock option plan of the Company (99.92% For and 0.08% Against) at the Annual General and Special Meeting held on June 23, 2022. The amendments were made to comply with the TSX Venture Exchange’s updated rules regarding option plans. For a full copy of the Plan, please see the Management Information Circular dated May 15, 2022 which was filed under the Company’s profile on SEDAR at www.sedar.com on June 2, 2022 and is available on the Company’s website at www.montagegoldcorp.com.

The Company also announces that it has granted an of aggregate of 200,000 incentive stock options to a Côte d’Ivoire based legal advisor to the Company. The options are exercisable, subject to vesting provisions, over a period of three years at a price of C$0.60 per share and subject to the successful closing of the Mankono Transaction.

MINERAL RESOURCE MODELING AND ESTIMATION ASSUMPTIONS – GBONGOGO

An Inferred MRE was undertaken by MPR who estimated recoverable mineral resources using Multiple Indicator Kriging (“MIK”) based on a dataset that includes 6,142.4m drilling data (4,827.4m of core and 1,315m of RC) supplied by Montage in April 2022. The MRE has been classified in the inferred category and reported in accordance with NI 43-101 and classifications adopted by CIM Council in May 2014 and has an effective data of the 22nd of April 2022.

Inferred Mineral Resources were estimated for Gbongogo by MIK of two metre down-hole composited gold grades from RC and diamond drilling. Estimated resources include a variance adjustment to give estimates of Inferred Mineral Resources above gold cut-off grades for selective mining unit dimensions of 5m by 10m by 5m (cross strike, strike, vertical).

Micromine software was used for data compilation, domain wire framing and coding of composite values and GS3M was used for resource estimation. The resulting estimates were imported into Micromine for pit optimization and resource reporting.

Inferred Mineral Resources have been estimated within a single mineralized envelope 675m in length and up to 120m in true width.

The MRE includes bulk densities of 1.30, 2.40 and 2.66 t/bcm for oxide, transition and fresh Quartz Diorite, respectively, and 1.30, 2.10 and 2.62 t/bcm for the surrounding sediments. This is on the basis of 702 immersion density measurements performed by the Barrick/Endeavour on diamond core samples.

To satisfy the definition of Mineral Resources having reasonable prospects for eventual economic extraction, the estimates are constrained within an optimal pit and generated from the following key assumptions and parameters:

- Gold price of US$1,500/oz

- The MIK model is a recoverable resource model and mining recovery and dilution are taken into account within the modelling process.

- Processing recovery of 93.9% in oxide, 91.3% in transition material and 89.2% in fresh rock.

- Overall slope angle of 30° in oxide rock, 40° in transition and 55° in fresh material

- Average mining costs of US$2.74 per tonne

- Processing costs (including G&A) of US$7.41, US$7.58 and US$8.67 for oxide, transition and fresh material respectively based on the KGP DFS process costs

- Haulage costs of US$5.00/t

- Total selling costs (includes state and third-party royalties) of US$90/oz

The pit shell constraining the estimates extends over approximately 670m of strike to a maximum depth of around 220m.

QUALITY ASSURANCE/QUALITY CONTROL; SAMPLING; DATA VERIFICATION – GBONGOGO

All drilling was carried out under the supervision of Barrick personnel and utilized the following procedures and methodologies:

- RC drilling used a 5.25-inch face sampling pneumatic hammer with 1m samples collected into 60 litre plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to yield a 12.5% representative sample for submission to the analytical laboratory. The residual sample was stored at the drill site until assay results were received and validated. Field duplicates were collected by repeat splitting of the primary sample at an average frequency of around 1 duplicate per 10 primary samples.

- Diamond drill holes were drilled with PQ and HQ diamond drill bits. The core marked up and logged, and generally 1m samples (minimum 0.2m) were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Barrick core yard at Fadiadougou. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment. Field duplicates were taken by crushing the half core sample to -2mm and splitting 50:50 using a riffle splitter at an average frequency of around 1 duplicate per 24 primary samples.

- Samples were shipped to the SGS laboratory at Tongon or the Bureau Veritas Laboratory in Abidjan for preparation and assay. Both SGS and Bureau Veritas are independent of Barrick and Montage.

- At both laboratories, samples were dried and crushed by the laboratory to -2mm and a 1.5kg split prepared from the coarse crushed material for pulverizing to -75um. Gold analysis was undertaken using a 50-gram charge and fire assay with an atomic absorption finish. Quality control procedures included systematic insertion of blanks (Around 1:45), duplicates (1:24) and standards (Around 1:45) into the sample stream. Gold assay results of these QAQC samples show acceptable levels of precision and accuracy, with no indication of significant contamination, supporting the reliability of the primary data with sufficient confidence for the current resource estimates and exploration activities.

- Montage and MPR consider that the resource data has been sufficiently verified to form the basis of the current MRE and that the database is adequate for the current estimates. The author and Mr. Abbot consider that the data verification process included no limitations or failures.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project, located in northwest Côte d’Ivoire, which currently hosts a Probable Mineral Reserve of 161.1Mt grading 0.66g/t for 3.42M ounces of gold. The Company released the results of a DFS on the Koné Gold Project on February 14, 2022, outlining a 15-year gold project producing an estimated 3.06M ounces of gold over life of mine, with average annual production of 207koz, and estimated peak production of 320koz. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa.

TECHNICAL DISCLOSURE – GBONGOGO

The Mineral Resource Estimate for Gbongogo was carried out by Mr. Jonathon Abbott of MPR Geological Consultants of Perth, Western Australia who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101 (“NI 43-101”). Mr. Abbott consents to the inclusion in this press release of the information, in the form and context in which it appears.

TECHNICAL DISCLOSURE – KONÉ GOLD PROJECT

The Mineral Reserve Estimate for the Koné Gold Project has an effective date of February 14, 2022 and was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd. who is considered to be independent of Montage. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43-101.

The Mineral Resource Estimates for the Koné Gold Project have an effective date of August 12, 2021 and were carried out by Mr. Jonathon Abbott of MPR who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43-101.

For further details of the data verification undertaken, exploration undertaken and associated QA/QC programs, and the interpretation thereof, and the assumptions, parameters and methods used to develop the Mineral Reserve Estimate and the Mineral Resource Estimates for the Koné Gold Project, please see the definitive feasibility study, entitled "Koné Gold Project, Côte d'Ivoire Definitive Feasibility Study National Instrument 43-101 Technical Report" (the “DFS”) and filed on SEDAR at www.sedar.com. The DFS was prepared by Lycopodium Minerals Pty Ltd. and incorporates the work of Lycopodium and Specialist Consultants, including Mr. Abbott, under the supervision of Sandy Hunter, MAusIMM(CP), of Lycopodium, a Qualified Person pursuant to NI 43-101 who is independent of Montage. Readers are encouraged to read the DFS in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The DFS is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical contents of this press release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mr. Stuart is the President of the Company, a Chartered Geologist and a Fellow of the Geological Society of London.

CONTACT INFORMATION

Hugh Stuart

President

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the expected closing of the Mankono Transaction, the Company’s resource properties and resource estimates, and the Company’s plans, focus and objectives, including future exploration programs at Mankono and districtwide at the KGP, expectations that the Gbongogo Inferred Mineral Resource will become an Indicated Mineral Resource, and timing for an updated technical report on the KGP. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions, including, with respect to mineral resource estimates, those set out in the DFS and those set out under the heading “Mineral Resource Modeling and Estimation Assumptions”. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to gold and other commodity prices, including lower than expected future gold prices which could reduce the economic returns on, or the viability of, a deposit, uncertainties inherent in the exploration of mineral properties such as incorrect resource estimates due to incorrect modelling or unforeseen geological conditions, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s annual information form under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.