Montage Reports Positive Infill Drill Results Including 79.2m at 1.55g/t and Provides PEA Update

March 17, 2021

Vancouver, British Columbia — March 17, 2021 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV:MAU) is pleased to report initial results from its ongoing 35,000m infill drill program at the Morondo Gold Project (“MGP”) in Côte d’Ivoire.

“The continuity of mineralization at Koné continues to impress. Our 35,000m infill drill program is 50% complete and we are reporting results from an initial 12 drill holes representing 4,359m of core. This first batch of results includes five holes that rank among the top 10 of all core drilling completed at Koné to date. Results thus far are demonstrating a very high resource conversion from Inferred to Indicated. The infill program is on track to be completed by June, which will allow us to prepare the first Indicated Mineral Resource estimate for Kone in early Q3,” commented Hugh Stuart, CEO and Director of Montage.

“In parallel with the current drill program, Montage is advancing the Preliminary Economic Assessment (“PEA”) and we now expect to release results of the PEA in mid-May 2021. Environmental baseline work is progressing well, and Montage expects to submit the Environmental and Social Impact Assessment to the Côte d'Ivoire government in late 2021. Efforts are also underway expanding regional exploration outside of the Koné resource area to identify high-grade satellite pits to deliver supplemental feed to a regional process plant to be located at Koné. Early results from this exploration initiative are positive with the Petit Yao target delivering intercepts grading up to 4.15g/t across a 12m interval starting at surface.”

HIGHLIGHTS

- 35,000m infill drill program 50% complete as of March 17, 2021

- Initial results from infill program are confirming, or improving upon existing mineralization within the core of the Koné deposit, including:

- MDD034: 90.0m grading 1.06g/t within 226.1m at 0.85g/t

- MDD037: 122.0m grading 1.19g/t within 239.1m at 0.88g/t

- MDD042: 79.2m grading 1.55g/t within 234.2m at 0.88g/t

- MDD044: 107.7m grading 1.05g/t within 213.0m at 0.85g/t

- PEA results anticipated by mid-May 2021.

- Indicated Mineral Resource update expected in Q3 2021.

- $30M cash on hand and fully funded to advance the MGP to completion of a Feasibility Study by end of 2021.

DETAILS

Infill Drill Program Initial Results

The 35,000m infill drill program started in January with five diamond core rigs and one RC rig and is designed to convert the existing Inferred Mineral Resource of 123Mt grading 0.80g/t for 3.16Moz (at 0.40g/t cut-off) to the Indicated Mineral Resource category and to support the completion of a Feasibility Study by the end of 2021.

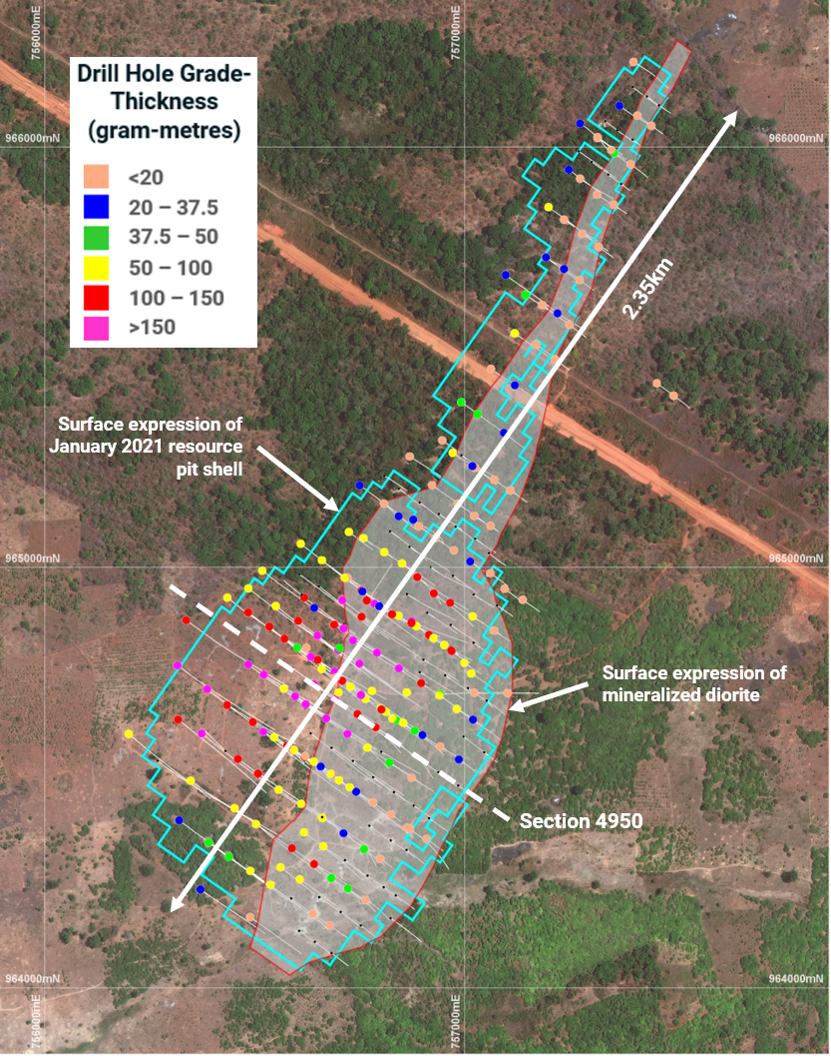

A total of 17,700m of infill drilling has been completed since January 2021, with assay results received for 12 holes representing 4,359m of core. The results received span several infill sections of the deposit. A drill plan map with collars coloured by grade-thickness is shown below for all drilling completed to date on the Koné deposit.

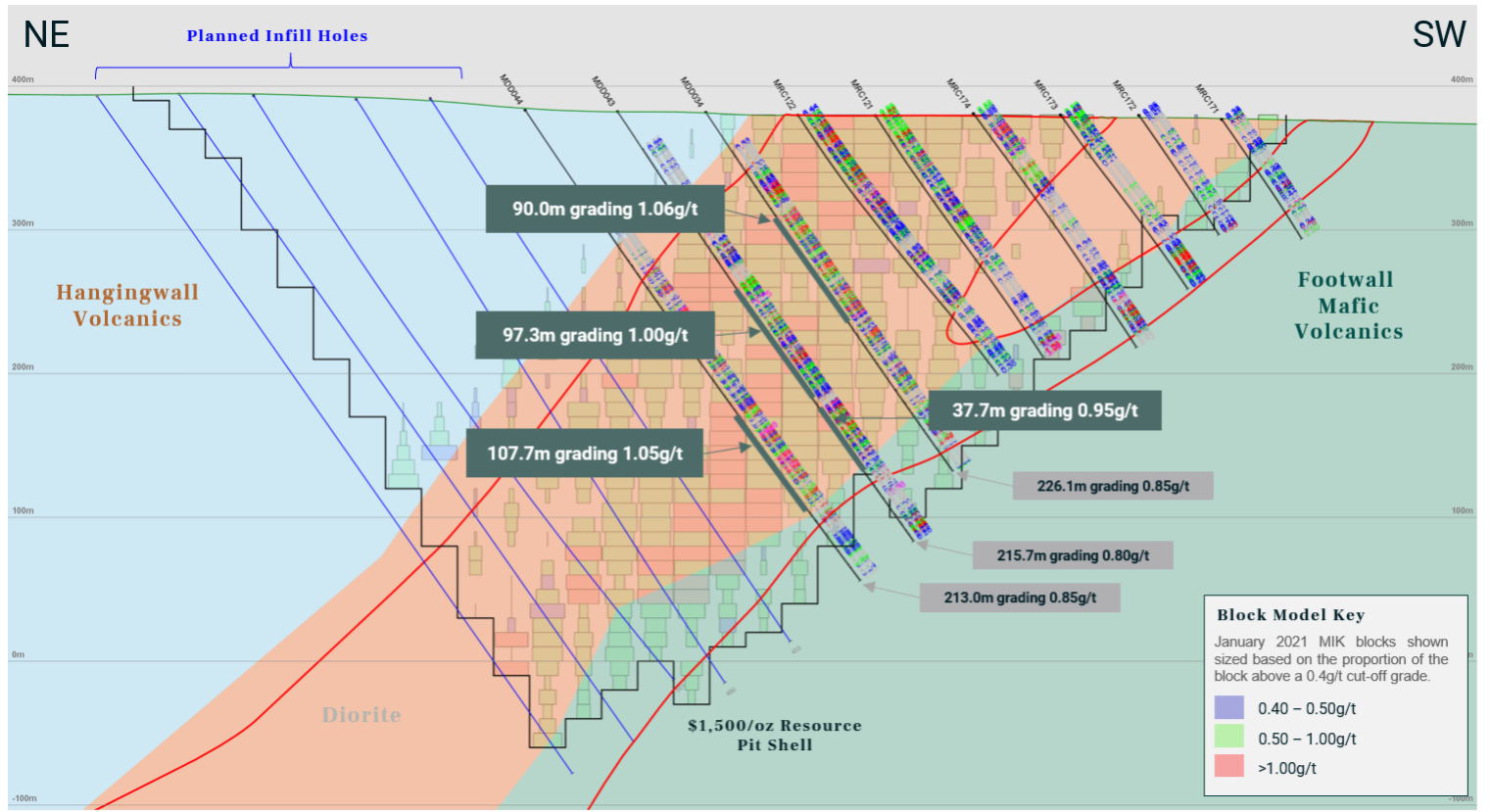

The cross-section below (Figure 2), shows infill results on section 4950, together with resource blocks from the January 2021 Inferred Mineral Resource. The grades reported from this latest core drilling are in-line with, or higher than grades reported in the previous block model.

Selected infill drill results are shown below with complete details provided in Appendix 1 of this release.

| Hole | Section | From | To | Metres | Au g/t | |

|---|---|---|---|---|---|---|

| MDD034 | 4950 | including | 55.9 | 282.0 | 226.1 | 0.85 |

| 87.0 | 177.0 | 90.0 | 1.06 | |||

| MDD037 | 5050 | including | 75.0 | 314.0 | 239.1 | 0.88 |

| 148.0 | 270.0 | 122.0 | 1.19 | |||

| MDD038 | 5050 | including | 27.5 | 279.0 | 251.5 | 0.78 |

| 165.0 | 205.0 | 40.0 | 1.65 | |||

| MDD042 | 5150 | including | 54.0 | 288.2 | 234.2 | 0.88 |

| 209.0 | 288.2 | 79.2 | 1.55 | |||

| MDD043 | 4950 | including | 98.0 | 313.7 | 215.7 | 0.80 |

| 147.7 | 245.0 | 97.3 | 1.00 | |||

| MDD044 | 4950 | including | 139.0 | 352.0 | 213.0 | 0.85 |

| 249.0 | 352.0 | 103.0 | 1.07 |

Note: Intercept widths are +90% of true width

NI 43-101 Technical Report Filed

On March 11, 2021, Montage filed a 43-101 Technical Report on the Morondo Gold Project with an effective date of January 27, 2021 and is entitled “NI 43-101 Technical Report for the Morondo Gold Project, Côte d’Ivoire”. The purpose of the Technical Report is to support the previous disclosure of the Inferred Mineral Resource estimate reported by the Company on January 28, 2021. The Technical Report was prepared in accordance with the Canadian Securities Administrator’s National Instrument 43-101 – Standards for Disclosure for Mineral Projects; and is available for review under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at www.montagegoldcorp.com.

PEA Update

Numerous work streams continue to progress well as part of the PEA including the mining study, tailings and water storage design, environmental impact assessment, detailed engineering and design work. As previously reported, the hydrological, geotechnical, and metallurgical studies have all been completed.

Based upon recent positive test results, the Company is currently conducting a trade-off analysis in respect of the power supply and the design of the crushing and grinding circuit of the processing facility to maximize economics. This review is expected to delay the delivery of the PEA slightly. The release of the PEA results is now anticipated for mid-May of this year. This minor delay will lead to optimized project economics and will have minimal impact on the timing of the completion and delivery of the Feasibility Study.

Business Plan Fully Funded for 2021

Montage remains fully funded for its business plan through 2021. This includes the completion of the current 35,000m drill program, the delivery of the PEA results in mid-May 2021; an Indicated Mineral Resource estimate in early Q3 2021; and a Feasibility Study by the end of 2021.

As of February 28, 2021, Montage had a cash balance of C$30 million.

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSXV:MAU) is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Morondo Gold Project, located in northwest Côte d’Ivoire, which currently hosts an Inferred Mineral Resource of 123Mt grading 0.80 g/t for 3.16Moz of gold, based on a 0.4 g/t cutoff grade. Montage has a management team and board with significant experience in discovering and developing gold deposits in Africa. The Company is rapidly progressing work programs at the Morondo Gold Project towards completion of a Feasibility Study by the end of 2021.

QUALIFIED PERSONS STATEMENT

The technical contents of this release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to National Instrument 43-101. Mr. Stuart is the Chief Executive Officer of the Company, a Chartered Geologist and a Fellow of the Geological Society of London. Samples used for the results described herein have been prepared and analyzed by fire assay using a 50-gram charge at the Bureau Veritas facility in Abidjan, Côte d’Ivoire. Field duplicate samples are taken and blanks and standards are added to every batch submitted.

CONTACT INFORMATION

Hugh Stuart

Chief Executive Officer

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the Company’s resource properties, and the Company’s plans, focus and objectives. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold and other commodity prices, uncertainties inherent in the exploration of mineral properties, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s final prospectus under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

APPENDIX 1: Core drilling Results for holes drilled post the January 2021 Inferred Mineral Resource Estimate

Note:

Shaded intervals represent the full mineralized width of the Koné deposit

Intercepts are +90% of true width

Grid: WGS84 UTM Zone 29N

| Hole | Collar Location | Dip (m) |

Orient Az/Dip |

Down-hole Intercept (m) | Au g/t Uncut |

||||

|---|---|---|---|---|---|---|---|---|---|

| mE | mN | mRl | From | To | Metres | ||||

| MDD033 | 756,371 | 964,234 | 372 | 305.9 | 124.1/-56.6 | 196.70 | 278.20 | 81.50 | 0.45 |

| 201.00 | 276.00 | 75.00 | 0.47 | ||||||

| MDD034 | 756,692 | 964,687 | 382 | 302.8 | 124.7/-56.6 | 55.90 | 282.00 | 226.10 | 0.85 |

| 55.90 | 80.95 | 25.05 | 0.88 | ||||||

| 87.00 | 177.00 | 90.00 | 1.06 | ||||||

| 246.90 | 282.00 | 35.10 | 1.11 | ||||||

| MDD035 | 756,650 | 964,838 | 387 | 350.8 | 127.2/-56.2 | 103.00 | 329.10 | 226.10 | 0.68 |

| 127.00 | 136.30 | 9.30 | 1.53 | ||||||

| 193.00 | 221.95 | 28.95 | 1.06 | ||||||

| 227.00 | 263.00 | 36.00 | 1.24 | ||||||

| 273.00 | 307.00 | 34.00 | 0.94 | ||||||

| MDD036 | 756,485 | 964,950 | 395 | 500.9 | 127.1/-57.2 | 227.70 | 455.00 | 227.30 | 0.33 |

| 245.00 | 278.00 | 33.00 | 0.51 | ||||||

| 314.10 | 394.00 | 79.90 | 0.45 | ||||||

| MDD037 | 756,699 | 964,803 | 385 | 350.7 | 125.1/-56.4 | 74.95 | 314.00 | 239.05 | 0.88 |

| 74.95 | 89.00 | 14.05 | 1.68 | ||||||

| 148.00 | 270.00 | 122.00 | 1.19 | ||||||

| 289.00 | 314.00 | 25.00 | 0.56 | ||||||

| MDD038 | 756,750 | 964,771 | 384 | 305.7 | 125.6/-56.7 | 27.55 | 279.00 | 251.45 | 0.78 |

| 51.00 | 77.40 | 26.40 | 1.28 | ||||||

| 94.00 | 140.00 | 46.00 | 0.96 | ||||||

| 165.00 | 205.00 | 40.00 | 1.65 | ||||||

| 260.00 | 279.00 | 19.00 | 0.86 | ||||||

| MDD039 | 756,755 | 964,882 | 394 | 302.7 | 126.5/-55.7 | 41.80 | 257.00 | 215.20 | 0.65 |

| 40.20 | 57.00 | 16.80 | 0.66 | ||||||

| 123.60 | 197.00 | 73.40 | 1.23 | ||||||

| 208.00 | 233.00 | 25.00 | 0.51 | ||||||

| 239.55 | 255.00 | 15.45 | 0.46 | ||||||

| MDD040 | 756,604 | 964,873 | 394 | 389.8 | 127.6/-55.8 | 136.00 | 384.00 | 248.00 | 0.50 |

| 144.00 | 170.00 | 26.00 | 0.70 | ||||||

| 257.15 | 290.00 | 32.85 | 0.98 | ||||||

| 303.00 | 348.00 | 45.00 | 0.89 | ||||||

| MDD041 | 756,550 | 964,908 | 394 | 449.8 | 126.4/-56.5 | 186.00 | 410.25 | 224.25 | 0.39 |

| 320.80 | 381.50 | 60.70 | 0.83 | ||||||

| MDD042 | 756,709 | 964,922 | 393 | 335.7 | 125.1/-56.7 | 54.00 | 288.20 | 234.20 | 0.88 |

| 53.00 | 85.00 | 32.00 | 0.63 | ||||||

| 150.00 | 192.00 | 42.00 | 0.88 | ||||||

| 209.00 | 288.20 | 79.20 | 1.55 | ||||||

| MDD043 | 756,642 | 964,722 | 382 | 362.7 | 126.1/-56.0 | 98.00 | 313.65 | 215.65 | 0.80 |

| 147.70 | 245.00 | 97.30 | 1.00 | ||||||

| 252.35 | 290.00 | 37.65 | 0.95 | ||||||

| 342.85 | 359.00 | 16.15 | 0.66 | ||||||

| MDD044 | 756,590 | 964,760 | 383 | 401.7 | 124.9/56.6 | 139.00 | 352.00 | 213.00 | 0.85 |

| 151.05 | 227.00 | 75.95 | 0.62 | ||||||

| 249.00 | 352.00 | 103.00 | 1.07 | ||||||