Montage Gold Corp. Reports Final Infill Drill Results and Provides Project Updates

August 9, 2021

Vancouver, British Columbia — August 9, 2021 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCPK: MAUTF) is pleased to report the final drill results from the Company’s infill and expansion drill program and updates on the ongoing Feasibility Study and other activities at the Company’s Koné Gold Project (“KGP”) in Côte d’Ivoire.

Hugh Stuart, Montage CEO commented, “Infill drilling is complete, and we are focused on finalizing the maiden Indicated Mineral Resource Estimate for the KGP. Infill drilling has consistently demonstrated broad zones of homogenous mineralization throughout the deposit which has given Management a high degree of confidence in the conversion of Mineral Resources from the Inferred to Indicated category. Given the nature of the mineralization and the conservatism of our modelling approach we are expecting a conversion rate of over 90%. The upcoming resource update is a critical input for the ongoing Feasibility Study, and we look forward to delivering this milestone to our shareholders imminently.

“The Feasibility Study remains on track for completion by year-end 2021 with several work programs in progress. All geotechnical drilling has been completed and hydrological drilling will be completed by the end of August. The metallurgical test program is underway at SGS Lakefield in Canada and the environmental baseline study is complete. Engineering design work continues to progress with Lycopodium Minerals Pty Ltd. (“Lycopodium”) and Knight Piesold.

“Management is also expecting the issue of new Exploration Licenses within the KGP area in the coming quarter. Once issued, Montage will be able to conduct district-scale exploration outside of the Koné deposit for the first time. Montage holds exploration applications covering 1,142km2 of unexplored ground within trucking distance of the Koné deposit.”

HIGHLIGHTS

- Results from infill program continue to confirm, or improve upon, existing mineralization within the core of the Koné deposit, including:

- MDD106: 80.15m grading 1.13g/t within 294.00m grading 0.90g/t

- MDD111: 46.00m grading 2.81g/t within 226.05m grading 1.23g/t

- Updated Mineral Resource Estimate underway.

- Targeting +90% conversion from Inferred to Indicated category; and

- Resource update expected by mid-August.

- Feasibility Study on track for delivery by year-end 2021.

- Environmental and Social Impact Assessment (“ESIA”) continues to advance.

- Community consultations now completed; and

- Environmental baseline study completed.

- New Exploration Licenses anticipated in coming quarter.

DETAILS

Drill Results

Montage has been continuously drilling since January 2021 with as many as seven drill rigs in operation. The infill/expansion drill program is now complete with a total of 60,155m completed (38,497m core, 21,658m RC). In total, just over 100,000m of drilling (all categories) has now been completed at the Koné deposit.

The primary aim of the infill drilling is to upgrade the existing Inferred Mineral Resource to the Indicated Mineral Resource category in support of the ongoing Feasibility Study. Due to the consistency of mineralization at Koné and our conservative resource modelling approach we expect a high degree of conversion, and this has been reinforced by the assay results received since the start of the program.

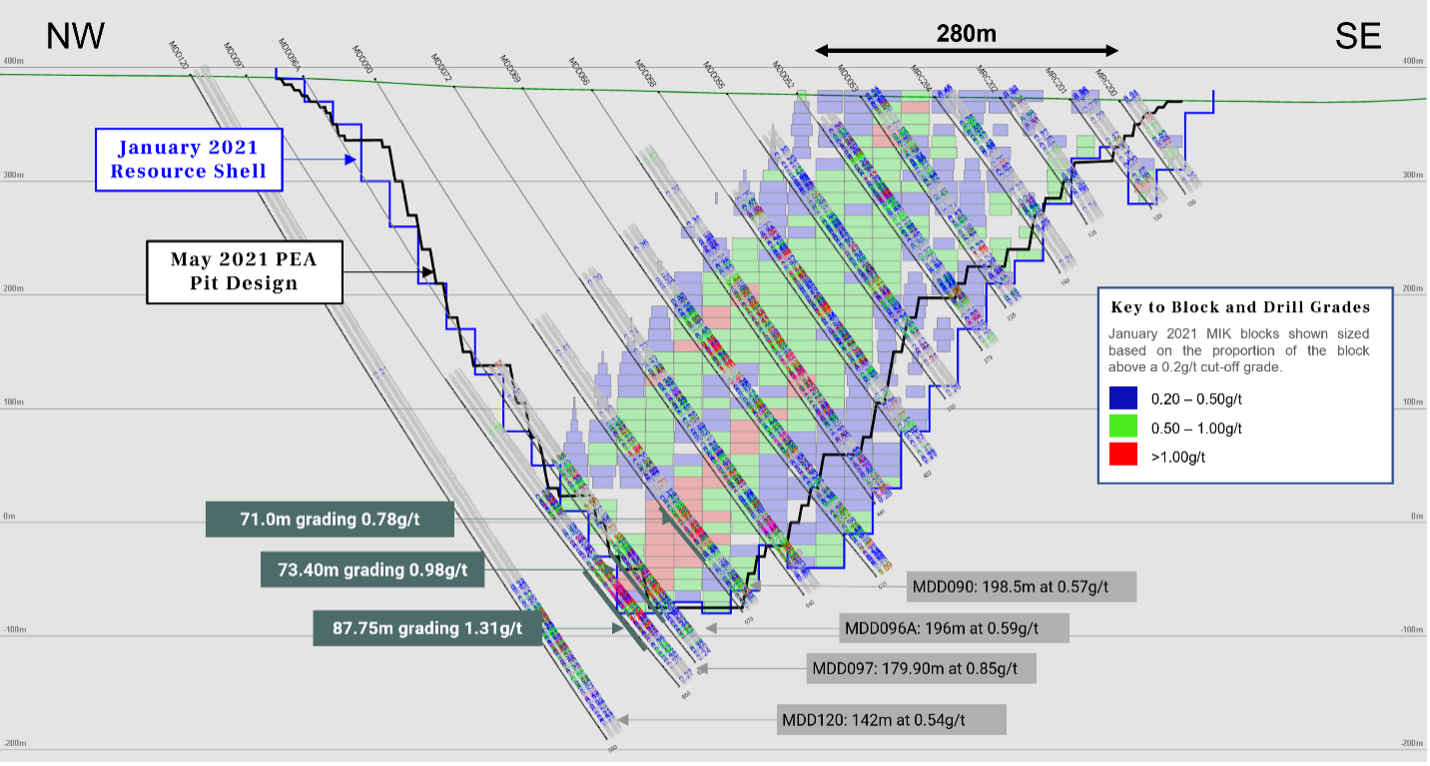

The infill section shown below shows the January 2021 Inferred Mineral Resource model overlain with results from drilling completed since that time and coloured in the same way. The grade profile in both the resource model and infill drill assays are very similar and support our expectation that +90% of the Inferred Mineral Resource estimate will be converted to the Indicated Mineral Resource category.

In addition, drill holes have been targeted to test the depth extension of mineralization below the current PEA Pit design. As the section above also shows the current PEA pit design lies very close to the base of the resource model and has the potential to go deeper providing further upside to the project. Based on the drilling completed below the PEA Pit, we are expecting incremental growth to the Koné deposit, and this will be reflected in the upcoming Mineral Resource Estimate. The complete table of drill results reported in this release is included as Appendix 1.

Feasibility Study Update

Several work programs are underway in support of the ongoing Feasibility Study for the KGP, including design and engineering by Lycopodium and Knight Piesold. The Feasibility Study is targeted for completion by the end of 2021.

The company has shipped additional material to SGS Lakefield in Ontario, Canada (for a total of 2,721kg in 164 samples) for leaching and comminution variability testing. These samples were selected to be representative of the grade profile and rock types of the Koné deposit to better support the estimates that will be incorporated into the Feasibility Study. Montage has also shipped 350 samples totalling 795kg for acid rock drainage testing by Genalysis Laboratory Services PTY Ltd in Perth, Australia.

All geotechnical drilling has been completed for the Feasibility Study pit design under the supervision of SRK as well as for the tailings storage facilities (Knight Piesold). Hydrological drilling is expected to be completed by the end of August.

Permitting Efforts

The ESIA is advancing with all field related work and community consultations now complete. Support for the project is strong and Montage will continue to engage with local communities and government bodies as the permitting process advances.

The environmental baseline study is complete, and the Company anticipates the submission of the ESIA in September. Based on precedent, the Company believes it will be possible to have both environmental and mining permits in hand in early 2022.

Exploration Licenses

The Company has been making progress regarding its exploration applications within the Koné Gold Project area. The Company expects to receive at least one new Exploration License in the coming quarter. The Company is excited at the prospect of conducting district exploration for the first time, with a strategy to identify satellite pits that can be mined and trucked to a central processing facility at the Koné Gold Project.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project, located in northwest Côte d’Ivoire, which currently hosts an Inferred Mineral Resource of 211Mt grading 0.59g/t for 4.00Moz of gold, based on a 0.20g/t cutoff grade (please see the NI 43-101 Technical Report titled “Preliminary Economic Assessment for the Koné Gold Project” available on the Company’s website at www.montagegoldcorp.com and under the Company’s profile at www.sedar.com). Montage has a management team and board with significant experience in discovering and developing gold deposits in Africa. The Company is rapidly progressing work programs at the Koné Gold Project towards completion of a Feasibility Study by the end of 2021.

QUALIFIED PERSONS STATEMENT

The technical contents of this release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to National Instrument 43-101. Mr. Stuart is the Chief Executive Officer of the Company, a Chartered Geologist and a Fellow of the Geological Society of London. Samples used for the results described herein have been prepared and analyzed by fire assay using a 50-gram charge at the Bureau Veritas facility in Abidjan, Côte d’Ivoire and at Intertek in Tarkwa Ghana. Field duplicate samples are taken and blanks and standards are added to every batch submitted.

CONTACT INFORMATION

Hugh Stuart

Chief Executive Officer

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the Company’s resource properties, and the Company’s plans, focus and objectives. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold and other commodity prices, uncertainties inherent in the exploration of mineral properties, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s final prospectus under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

APPENDIX 1: Core Drilling Results for Assays Received after the June 22, 2021 Press Release

Note:

Bolded intervals represent the full mineralized width of the Koné deposit

Intercepts are +90% of true width

* Denotes drill holes below current Inferred Mineral Resource Estimate

Grid: WGS84 UTM Zone 29N

| Hole | Collar Location | Depth | Orient | Down-hole Intercept (m) | Au g/t | ||||

| mE | mN | mRl | (m) | Az/Dip | From | To | Length | Uncut | |

| MDD075 | 756,400 | 964,458 | 376 | 395.7 | 127/-57 | 222.00 | 395.70 | 173.70 | 0.36 |

| 253.00 | 264.30 | 11.30 | 0.70 | ||||||

| 276.70 | 298.00 | 21.30 | 1.03 | ||||||

| MDD079 | 756,548 | 964,725 | 384 | 476.8 | 126/-57 | 156.00 | 383.00 | 227.00 | 0.72 |

| 184.00 | 192.00 | 8.00 | 0.69 | ||||||

| 200.00 | 236.00 | 36.00 | 1.11 | ||||||

| 269.95 | 368.15 | 98.20 | 0.93 | ||||||

| MDD091 | 756,460 | 964,238 | 372 | 272.8 | 125/-57 | 115.60 | 253.80 | 138.20 | 0.48 |

| 136.00 | 155.00 | 19.00 | 0.77 | ||||||

| 159.00 | 186.35 | 27.35 | 0.49 | ||||||

| 209.00 | 236.00 | 27.00 | 0.66 | ||||||

| MDD095 | 756,878 | 964,555 | 379 | 275.8 | 125/-57 | 0.00 | 183.55 | 183.55 | 0.54 |

| 0.00 | 53.00 | 53.00 | 0.66 | ||||||

| 136.25 | 156.00 | 19.75 | 2.00 | ||||||

| MDD096A | 756,269 | 964,734 | 392 | 620.8 | 130/-59 | 404.00 | 600.00 | 196.00 | 0.59 |

| 404.00 | 438.90 | 34.90 | 0.52 | ||||||

| 491.60 | 565.00 | 73.40 | 0.98 | ||||||

| MDD097* | 756,230 | 964,766 | 393 | 660.0 | 128/-59 | 451.00 | 630.90 | 179.90 | 0.85 |

| 451.00 | 477.00 | 26.00 | 0.78 | ||||||

| 525.25 | 613.00 | 87.75 | 1.31 | ||||||

| MDD098 | 756,956 | 965,419 | 379 | 251.6 | 127/-56 | 235.05 | 248.10 | 13.05 | 0.83 |

| MDD099 | 756,766 | 965,001 | 392 | 270.8 | 126/-56 | 43.00 | 235.10 | 192.10 | 0.46 |

| 45.00 | 51.00 | 8.00 | 0.94 | ||||||

| 92.70 | 134.70 | 42.00 | 0.55 | ||||||

| 168.00 | 193.00 | 24.20 | 0.71 | ||||||

| MDD100 | 756,713 | 965,032 | 395 | 302.6 | 127/-56 | 106.00 | 264.65 | 158.65 | 0.61 |

| 106.00 | 125.75 | 19.75 | 0.76 | ||||||

| 145.00 | 168.25 | 23.25 | 0.55 | ||||||

| MDD101 | 756,429 | 964,564 | 381 | 477.2 | 127/-58 | 233.00 | 412.00 | 179.00 | 0.70 |

| 238.00 | 352.00 | 114.00 | 0.84 | ||||||

| 380.80 | 406.00 | 25.20 | 0.75 | ||||||

| 453.05 | 471.00 | 17.95 | 0.61 | ||||||

| MDD102* | 756,395 | 964,898 | 394 | 551.8 | 127/-59 | 341.00 | 541.00 | 200.00 | 0.30 |

| 391.00 | 417.00 | 26.00 | 0.61 | ||||||

| 455.00 | 478.00 | 23.00 | 0.71 | ||||||

| MDD103 | 756,855 | 964,810 | 385 | 224.8 | 125/-57 | 0.00 | 208.00 | 208.00 | 0.82 |

| 0.00 | 22.20 | 22.20 | 0.86 | ||||||

| 39.00 | 80.00 | 41.00 | 1.39 | ||||||

| 87.00 | 122.00 | 35.00 | 1.35 | ||||||

| 163.90 | 198.80 | 34.90 | 0.87 | ||||||

| MDD104 | 756,663 | 965,069 | 392 | 332.7 | 126/-56 | 158.00 | 177.00 | 19.00 | 0.67 |

| MDD105 | 756,314 | 964,829 | 392 | 600.0 | 126/-57 | 406.35 | 560.35 | 154.00 | 0.54 |

| 414.00 | 426.00 | 12.00 | 0.60 | ||||||

| 499.00 | 538.00 | 39.00 | 1.35 | ||||||

| 547.00 | 558.00 | 11.00 | 0.80 | ||||||

| MDD106 | 756,812 | 964,865 | 392 | 300.8 | 160/-57 | 5.00 | 299.00 | 294.00 | 0.90 |

| 10.00 | 41.00 | 31.00 | 1.00 | ||||||

| 79.50 | 159.65 | 80.15 | 1.13 | ||||||

| 164.75 | 214.00 | 49.25 | 1.38 | ||||||

| 239.00 | 270.02 | 31.02 | 1.13 | ||||||

| MDD107 | 756,271 | 964,675 | 385 | 602.8 | 127/-58 | 381.00 | 588.00 | 207.00 | 0.56 |

| 404.00 | 417.00 | 13.00 | 0.86 | ||||||

| 424.00 | 435.00 | 11.00 | 0.67 | ||||||

| 469.00 | 484.00 | 15.00 | 0.67 | ||||||

| 488.00 | 526.00 | 38.00 | 0.86 | ||||||

| 532.10 | 588.00 | 55.90 | 0.65 | ||||||

| MDD108* | 756,276 | 964,856 | 393 | 651.1 | 128/-59 | 438.00 | 621.00 | 183.00 | 0.64 |

| 530.00 | 581.45 | 51.45 | 1.35 | ||||||

| 593.00 | 620.45 | 27.45 | 1.02 | ||||||

| MDD109 | 756,778 | 965,118 | 394 | 200.8 | 125/-56 | 37.00 | 188.00 | 151.00 | 0.25 |

| 177.00 | 187.00 | 10.00 | 1.07 | ||||||

| MDD110* | 756,224 | 964,892 | 394 | 680.8 | 126/-58 | 484.00 | 677.30 | 193.30 | 0.60 |

| 484.00 | 506.00 | 22.00 | 0.55 | ||||||

| 595.00 | 624.00 | 29.00 | 1.38 | ||||||

| 632.00 | 677.30 | 45.30 | 0.86 | ||||||

| MDD111 | 756,783 | 964,741 | 381 | 269.8 | 125/-52 | 0.00 | 226.05 | 226.05 | 1.23 |

| 0.00 | 72.00 | 72.00 | 1.15 | ||||||

| 79.00 | 100.00 | 21.00 | 0.82 | ||||||

| 106.00 | 125.50 | 19.50 | 0.80 | ||||||

| 157.00 | 203.00 | 46.00 | 2.81 | ||||||

| MDD112 | 756,719 | 965,157 | 384 | 209.8 | 126/-56 | 121.00 | 186.00 | 65.00 | 0.39 |

| 158.00 | 185.00 | 27.00 | 0.56 | ||||||

| MDD113* | 756,251 | 964,805 | 392 | 641.7 | 129/-58 | 440.95 | 619.00 | 178.05 | 0.68 |

| 438.00 | 461.00 | 23.00 | 0.41 | ||||||

| 519.75 | 594.60 | 74.85 | 1.31 | ||||||

| MDD114* | 756,215 | 964,715 | 391 | 641.8 | 128/-58 | 419.00 | 634.00 | 215.00 | 0.57 |

| 440.00 | 467.00 | 27.00 | 0.86 | ||||||

| 503.50 | 545.90 | 42.40 | 0.87 | ||||||

| 555.55 | 593.00 | 37.45 | 0.89 | ||||||

| 620.70 | 637.00 | 16.30 | 0.58 | ||||||

| MDD115* | 756,345 | 964,928 | 394 | 576.1 | 127/-58 | 387.40 | 565.00 | 177.60 | 0.31 |

| 393.00 | 405.00 | 12.00 | 0.85 | ||||||

| 504.85 | 530.00 | 25.15 | 0.59 | ||||||

| 546.00 | 564.00 | 18.00 | 0.62 | ||||||

| MDD116A* | 756,302 | 964,899 | 394 | 626.8 | 126/-58 | 430.85 | 617.00 | 186.15 | 0.38 |

| 537.85 | 551.00 | 13.15 | 1.30 | ||||||

| 561.40 | 571.00 | 9.60 | 0.68 | ||||||

| 597.00 | 606.30 | 9.30 | 0.70 | ||||||

| MDD117A* | 756,203 | 964,839 | 394 | 680.8 | 128/-60 | 494.00 | 679.00 | 185.00 | 0.46 |

| 495.00 | 508.40 | 13.40 | 0.79 | ||||||

| 588.00 | 627.10 | 39.10 | 0.92 | ||||||

| 634.55 | 650.45 | 15.90 | 0.71 | ||||||

| 661.00 | 678.00 | 17.00 | 0.53 | ||||||

| MDD118 | 757,029 | 965,489 | 376 | 200.7 | 126/-56 | 78.00 | 176.00 | 98.00 | 0.29 |

| 82.65 | 95.00 | 12.35 | 0.68 | ||||||

| MDD119A | 756,165 | 964,686 | 391 | 635.8 | 128/-60 | 456.05 | 635.80 | 179.75 | 0.40 |

| 474.00 | 498.00 | 24.00 | 1.05 | ||||||

| 525.00 | 555.00 | 30.00 | 0.92 | ||||||

| MDD120 | 756,189 | 964,794 | 393 | 690.1 | 127/-60 | 534.00 | 676.00 | 142.00 | 0.54 |

| 558.00 | 591.40 | 33.40 | 0.76 | ||||||

| 595.40 | 640.00 | 44.60 | 0.65 | ||||||

| MDD121 | 756,246 | 964,940 | 394 | 671.0 | 128/-58 | 481.00 | 671.00 | 190.00 | 0.30 |

| 572.00 | 584.10 | 12.10 | 0.88 | ||||||

| 630.00 | 641.00 | 11.00 | 0.97 | ||||||

| 658.00 | 668.00 | 10.00 | 0.89 | ||||||

| MDD122 | 756,814 | 964,478 | 377 | 300.7 | 127/-58 | 0.00 | 90.00 | 90.00 | 0.26 |

| 36.00 | 49.00 | 13.00 | 0.94 | ||||||

| MDD123 | 757,173 | 965,883 | 372 | 257.7 | 126/-56 | 179.00 | 239.00 | 60.00 | 0.39 |

| 178.00 | 216.20 | 38.20 | 0.51 | ||||||

| MDD124A* | 756,171 | 964,745 | 393 | 680.8 | 128/-56 | 469.00 | 680.80 | 211.80 | 0.59 |

| 473.00 | 499.00 | 26.00 | 0.60 | ||||||

| 542.00 | 611.00 | 69.00 | 1.06 | ||||||

| 617.00 | 638.00 | 21.00 | 0.99 | ||||||

| MDD125 | 756,379 | 964,966 | 394 | 608.6 | 128/-58 | 359.05 | 564.85 | 205.80 | 0.26 |

| 456.00 | 472.00 | 16.00 | 1.03 | ||||||

| 554.00 | 566.00 | 12.00 | 0.54 | ||||||

| MDD126 | 756,559 | 964,960 | 395 | 431.8 | 127/-57 | 178.00 | 404.00 | 226.00 | 0.45 |

| 188.00 | 203.00 | 15.00 | 1.01 | ||||||

| 302.00 | 313.00 | 11.00 | 1.62 | ||||||

| 322.00 | 338.00 | 16.00 | 0.67 | ||||||

| 361.00 | 371.00 | 10.00 | 0.70 | ||||||

| MDD127* | 756,230 | 964,821 | 395 | 690.1 | 128/-57 | 462.35 | 641.00 | 178.65 | 0.51 |

| 555.00 | 578.00 | 23.00 | 1.32 | ||||||

| 583.00 | 597.00 | 14.00 | 1.91 | ||||||

| 602.00 | 608.60 | 6.60 | 0.70 | ||||||

| 622.00 | 640.00 | 18.00 | 0.49 | ||||||