Montage Gold Corp. Drills 6m grading 10.8g/t Near Surface 8km East of Koné

November 16, 2021

Vancouver, British Columbia — November 16, 2021 — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCPK: MAUTF) is pleased to report additional near surface high-grade drill results from the Petit Yao Central target within the Koné Gold Project (“KGP”) in Côte d’Ivoire. The Company is also pleased to provide an update on the ongoing Feasibility Study and permitting progress at the KGP as well as other exploration activities within the portfolio.

Hugh Stuart, Montage CEO commented, “We continue to be impressed with the high-grade drill results at Petit Yao Central which is showing potential as a satellite pit for the KGP. The mineralization sits near surface, predominantly in oxides, is shallow dipping and is open in all directions. This program will enable us to evaluate the resource potential of Petit Yao Central while we plan to test the strike extensions.

“Within the broader Petit Yao North area, recent soil sampling has identified several kilometres of new anomalism for further testing. Given the success at Petit Yao Central, we are highly encouraged by the potential to identify additional satellite pit targets near the Koné deposit.

“The Feasibility Study for the KGP is progressing well and we expect it to be completed in January 2022. Thus far, the test work and studies completed have largely confirmed the assumptions from the Preliminary Economic Assessment (“PEA”) from May 2021. We are expecting the maiden Mineral Reserves Estimate to be in-line with in-pit material reported from the PEA, with the production profile in early years improving slightly due to grade improvements demonstrated from the August 2021 Indicated Mineral Resource Estimate. Inflation impacts to operating and capital costs have been observed in some areas, however thus far we are also seeing improvements in other cost areas, driven by optimization work conducted as part of the Feasibility Study.”

HIGHLIGHTS

- Multiple Shallow High-grade drill results from Petit Yao Central including:

- MRPYRC030A: 6m grading 10.82g/t Au from 37m

- MRPYRC039: 3m grading 15.51g/t Au from 28m

- MRPYRC049: 4m grading 8.31g/t Au from 35m

- All results within 50m of surface in oxide zone

- Over 4km strike length of new anomalism to be drill tested in Petit Yao North area.

- Targets all within 10km from Koné deposit

- Detailed mapping underway on Faradougou Exploration License.

- 361.5km2 area previously unexplored; within trucking distance to Koné deposit

- Soil sampling program to commence in November 2021

- Feasibility Study on KGP progressing well; expected completion in January 2022.

- Soil program underway testing district scale anomaly on Korokaha South

DETAILS

Petit Yao Exploration Results

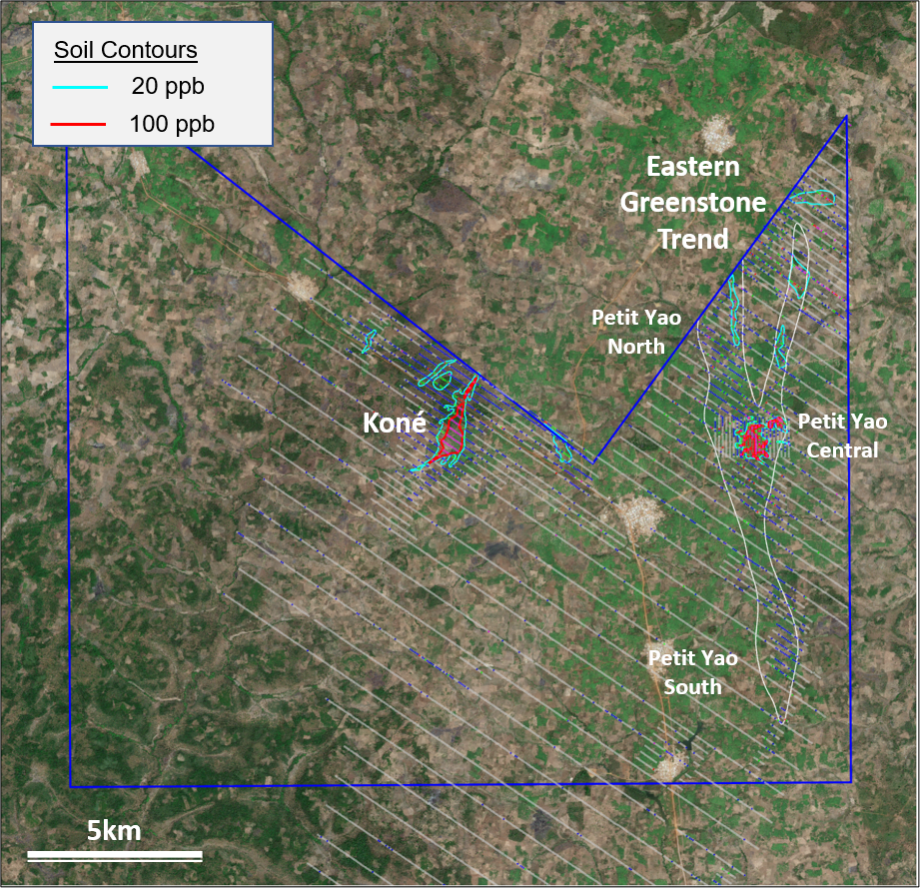

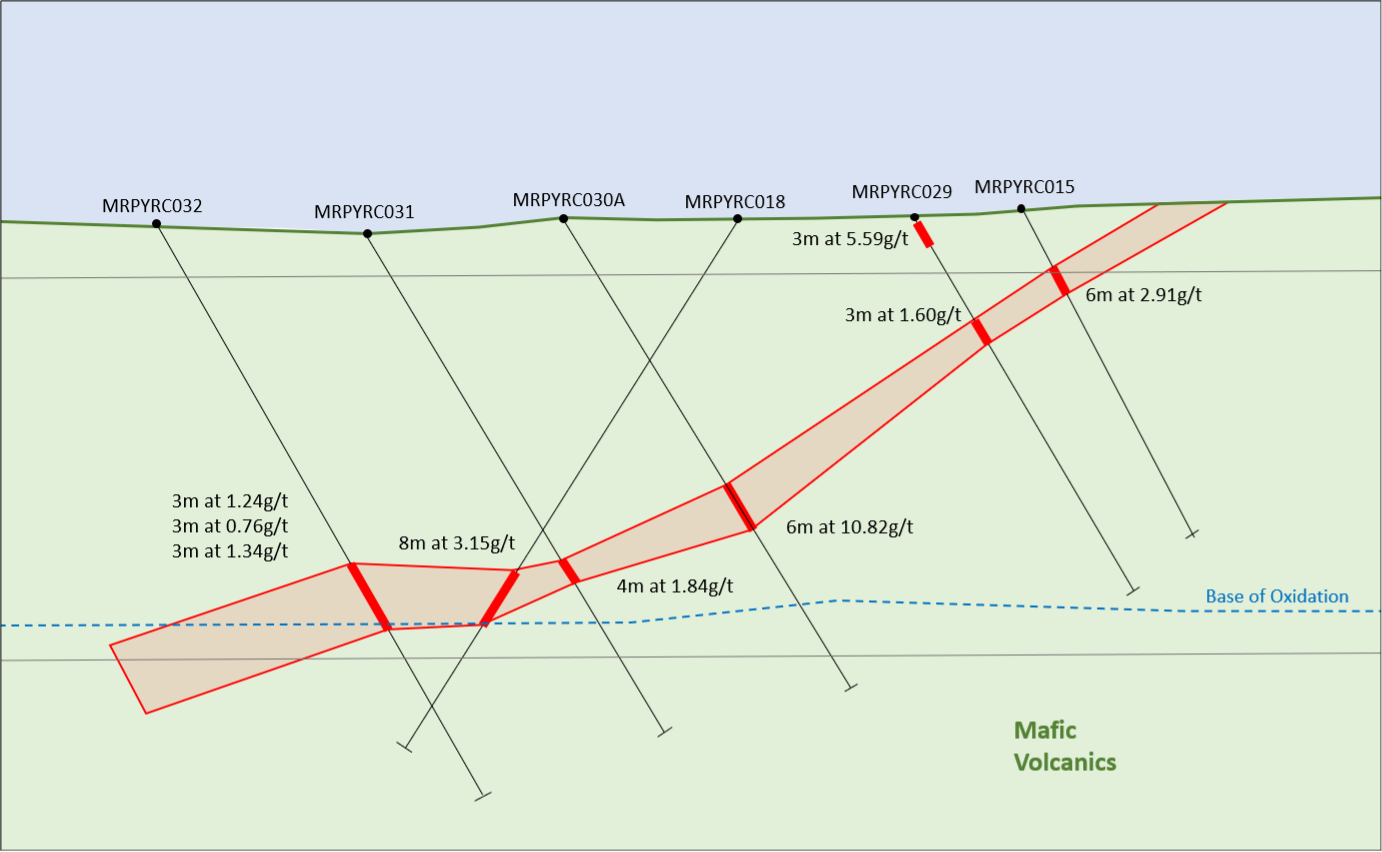

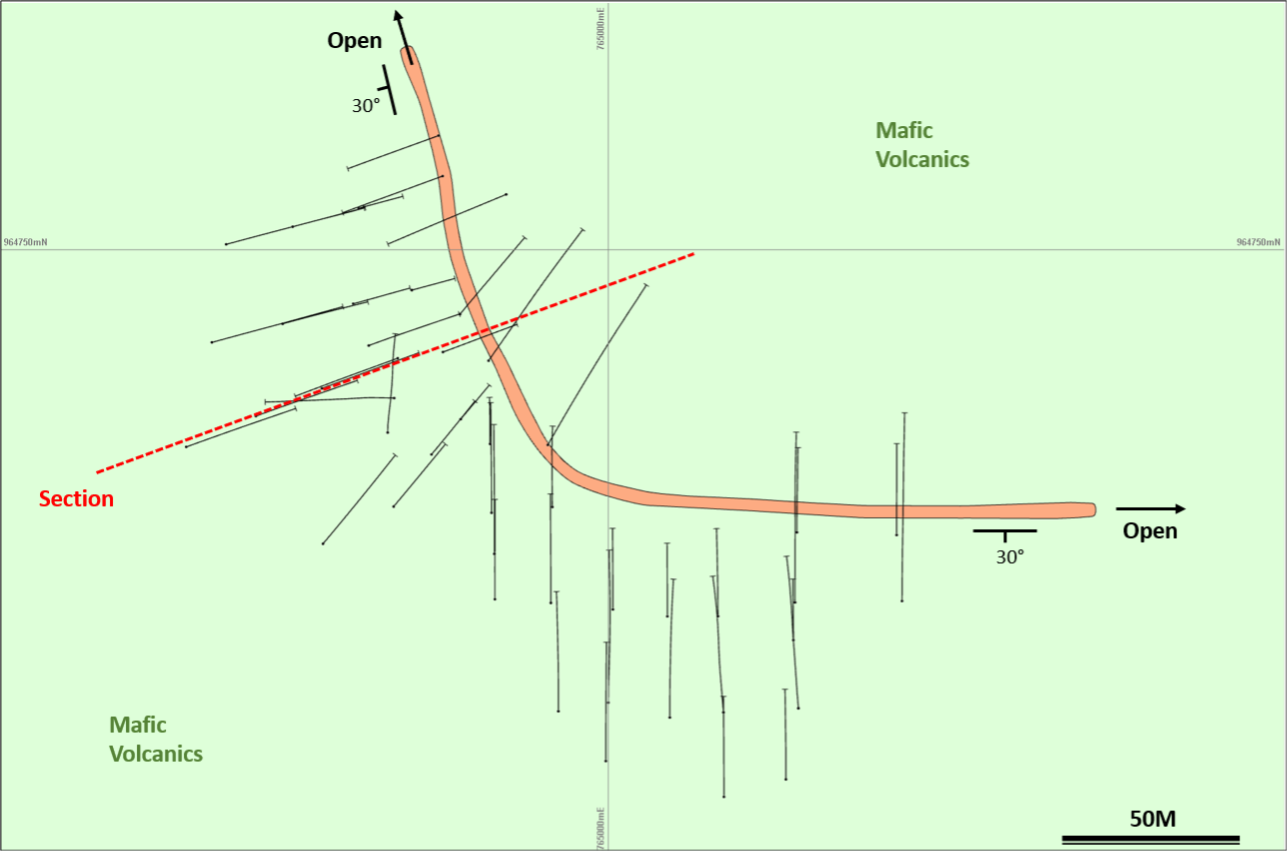

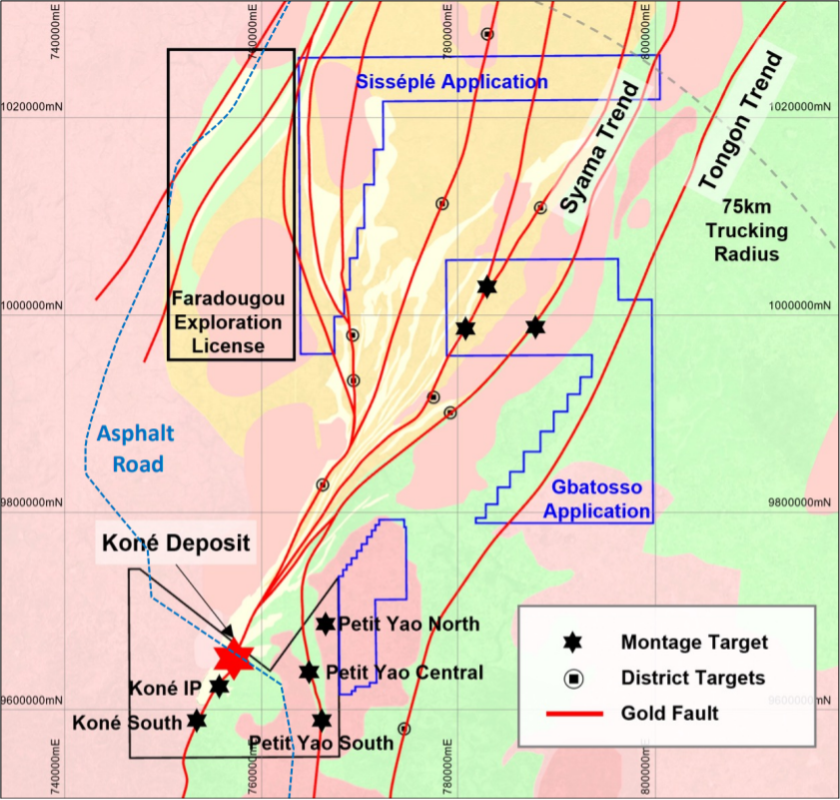

During October, Montage completed a 1,850m reverse circulation (“RC”) drilling program at the Petit Yao Central target, 8km east of the Koné deposit (Figure 1). The program was following up 2020 drilling that intersected a shallow dipping shear zone hosting one or more quartz veins. The current program successfully targeted high grade oxide mineralisation up to a maximum vertical depth of 50m and over a strike length of 300m (Figures 2 and 3).

Completed assay results from the program are being reported on 21 drill holes with numerous holes intersecting high grades notably, holes MRPYRC030A which returned 6m grading 10.82g/t from 37m and MRPYRC039 which intersected 3m grading 15.51g/t. Selected highlight drill holes are presented in Table 1 below. Complete data from Petit Yao Central drilling reported in this press release is included as Appendix A of this release.

Table 1: Highlight Drill Results from Petit Yao Central

| Hole | Down-hole Intercept (m) | Grade Au g/t |

||

| From | To | Metres | ||

| MRPYRC028 | 46 | 50 | 4 | 5.05 |

| MRPYRC029 | 13 | 17 | 4 | 1.60 |

| MRPYRC030A | 37 | 43 | 6 | 10.82 |

| MRPYRC039 | 28 | 31 | 3 | 15.51 |

| MRPYRC049 | 35 | 39 | 4 | 8.31 |

These results from Petit Yao Central are very encouraging. The key being that with the large-scale, low-cost operation being envisaged at the KGP, exploration no longer needs to find a standalone resource and the discovery of satellites as small as 50koz to 100koz that can be trucked within the KGP can have a significant impact on the economics of the project. The Company sees that potential in Petit Yao Central.

Once the remaining assays are received the company will evaluate Petit Yao Central as a satellite deposit feeding the KGP and will determine what further work needs to be completed to extend the known mineralisation which is open in all directions.

Figure 1: Koné Exploration License with Petit Yao Target Areas Highlighted

Figure 2: Petit Yao Central Cross Section 1 (Looking North)

Figure 3: Petit Yao Central Drill Map and Interpretation (Plan View)

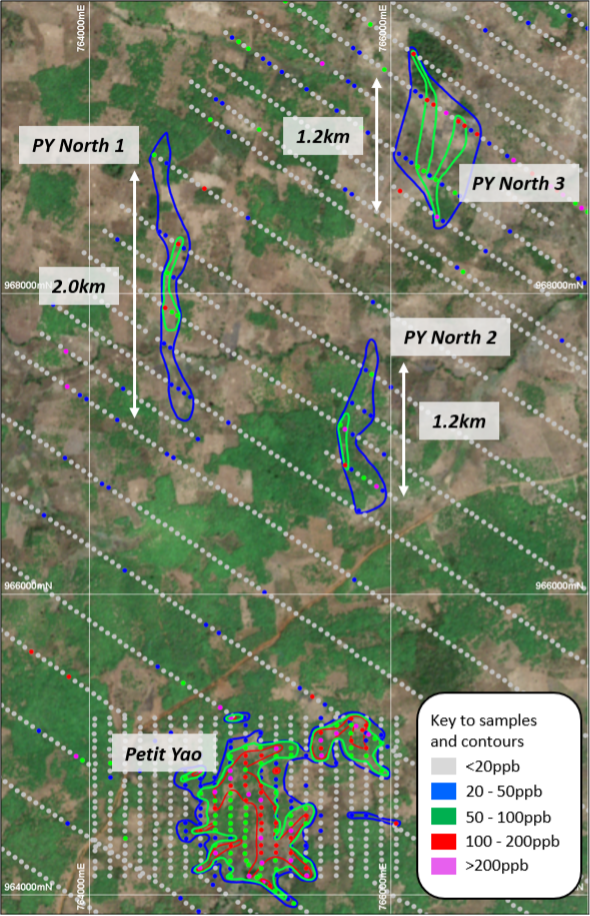

In the Petit Yao North area further soil sampling has defined three new anomalies covering a combined strike length of approximately 4.4km (see Figure 4). Follow up exploration in the form of deep pitting is in progress and results that are positive will be quickly followed up with shallow RC drilling.

Elsewhere in the Koné Exploration License the exploration team is evaluating new targets most notably the extension of the Petit Yao trend to the south.

Figure 4: Petit Yao Central and North Soil Anomalies

Faradougou Exploration Update

The Faradougou Exploration License (PR748, 361.5km2 surface area) was awarded in Q3 2021 and has an initial term of four years with up to two renewals, for a total potential term of nine years. There are no records of historic exploration on this license, and it carries no private third-party royalties.

An initial exploration program began in October with detailed geological mapping and is now nearing completion. A soil geochemistry program is set to start in the coming weeks with the aim to identify anomalism for further testing and eventual drilling if warranted. The southern most border of Faradougou sits approximately 30km due north of the Koné deposit and the entire license sits within trucking distance to the planned processing facility at the KGP.

Figure 5: Montage Exploration Licenses and Applications

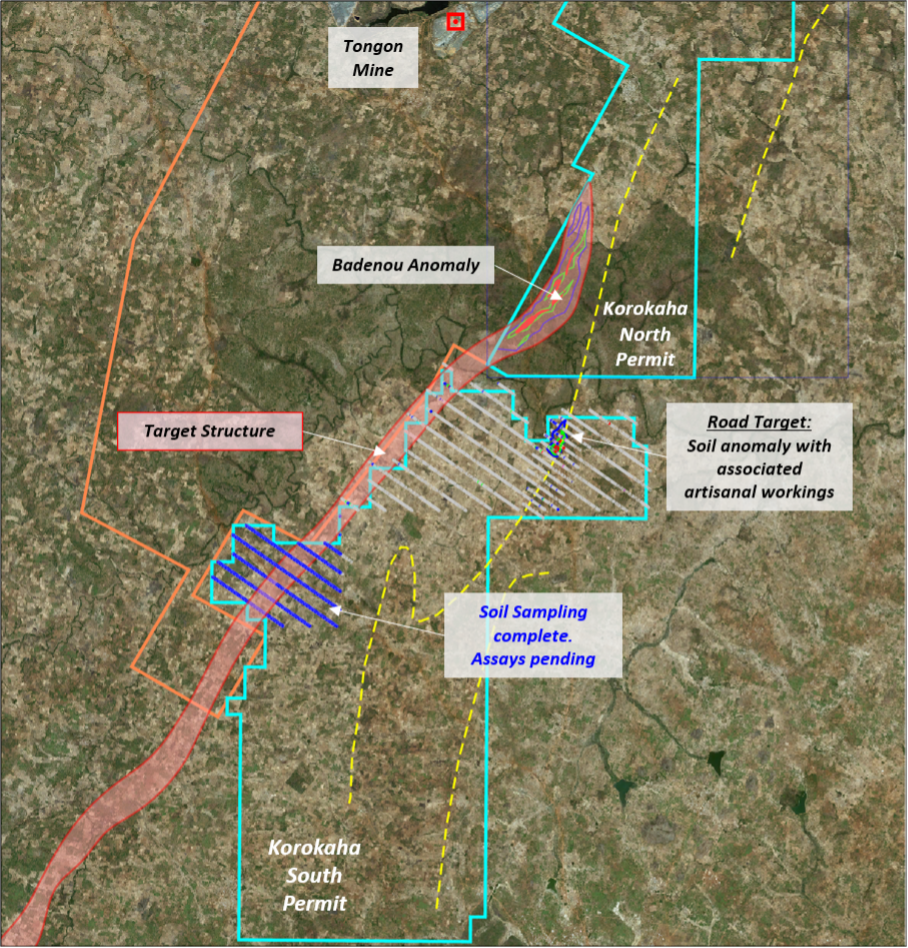

Korokaha South Exploration Update

The Korokaha Gold Project comprises two exploration licenses and one license application that sit adjacent to the Tongon Gold Mine operated by Barrick Gold Corp. A two-phase work program is currently underway on the Company’s Korokaha South Exploration License.

Figure 6: Korokaha Gold Project Exploration Plans

Phase one is a soil program within a regional structure on trend to the southwest of the Company’s Badenou anomaly (located on our Korokaha North Exploration License) and to the north east of an anomalous trend within Barrick’s license. The program will collect approximately 1,000 samples on an 800m by 25m grid along a 4km interpreted trend.

Phase two includes mapping and grab sampling a series of artisanal workings in close proximity to the Tongon mine access road. This work is a follow-up program on trend from a 500m strike length soil anomaly identified by Montage during earlier this year which is coincident with a series of artisanal workings.

KGP Feasibility Study Update

All major work programs are underway in support of the ongoing Feasibility Study for the KGP, with several studies now complete. To this point, all test work and studies have reaffirmed the assumptions for the KGP used in the PEA released in May 2021. The Feasibility Study is expected to be completed in January 2022.

Feasibility Study work program status:

- Geotechnical study – completed

- Metallurgical test work – completed

- Pit optimization – completed

- Pit design and scheduling – nearing completion

- Hydrological study – nearing completion

- Tailings disposal study – 70% completed

- Engineering and design – 20% completed

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Côte d’Ivoire. The Company’s flagship property is the Koné Gold Project, located in northwest Côte d’Ivoire, which currently hosts an Indicated Mineral Resource of 225Mt grading 0.59g/t for 4.27Moz of gold, based on a 0.20g/t cut-off grade and an Inferred Mineral Resource of 22Mt grading 0.45g/t for 0.32Moz of gold, based on a 0.20g/t cut-off grade. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa. The Company is rapidly progressing work programs at the Koné Gold Project towards completion of a Feasibility Study by the end of 2021.

QUALIFIED PERSONS STATEMENT

The technical contents of this release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to National Instrument 43-101. Mr. Stuart is the Chief Executive Officer of the Company, a Chartered Geologist and a Fellow of the Geological Society of London. Samples used for the results described herein have been prepared and analyzed by fire assay using a 50-gram charge at the Bureau Veritas facility in Abidjan, Côte d’Ivoire Field duplicate samples are taken and blanks and standards are added to every batch submitted.

CONTACT INFORMATION

Hugh Stuart

Chief Executive Officer

hstuart@montagegoldcorp.com

Adam Spencer

Executive Vice President, Corporate Development

aspencer@montagegoldcorp.com

mobile: +1 (416) 804-9032

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward looking Statements in this press release include statements related to the Company’s resource properties, and the Company’s plans, focus and objectives. Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties related to fluctuations in gold and other commodity prices, uncertainties inherent in the exploration of mineral properties, the impact and progression of the COVID-19 pandemic and other risk factors set forth in the Company’s final prospectus under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

APPENDIX 1: Drill Results from Petit Yao Central Completed Since September 8, 2021 Press Release

Note:

Intercepts are 80-100% of true width

Grid: WGS84 UTM Zone 29N

| Hole | Collar Location | Orientation | Depth | Down-hole Intercept (m) | Grade Au g/t |

|||||

| mE | mN | mRL | Azim | Dip | From | To | Metres | |||

| MRPYRC025 | 764,950 | 964,693 | 355 | 40 | -60 | 30 | No Significant Intercept | |||

| MRPYRC026 | 764,941 | 964,681 | 355 | 40 | -59 | 45 | 29 | 34 | 5 | 2.06 |

| MRPYRC027 | 764,928 | 964,664 | 354 | 40 | -60 | 55 | 42 | 45 | 3 | 1.15 |

| MRPYRC028 | 764,904 | 964,651 | 353 | 40 | -60 | 78 | 18 | 21 | 3 | 1.65 |

| 46 | 50 | 4 | 5.05 | |||||||

| MRPYRC029 | 764,944 | 964,716 | 356 | 70 | -60 | 52 | 0 | 3 | 3 | 5.59 |

| 13 | 17 | 4 | 1.60 | |||||||

| MRPYRC030A | 764,904 | 964,703 | 355 | 70 | -59 | 66 | 3 | 6 | 3 | 2.00 |

| 37 | 43 | 6 | 10.82 | |||||||

| MRPYRC031 | 764,882 | 964,694 | 354 | 70 | -59 | 70 | 44 | 48 | 4 | 1.84 |

| MRPYRC032 | 764,858 | 964,684 | 354 | 70 | -60 | 79 | 47 | 50 | 3 | 1.24 |

| 53 | 56 | 3 | 0.76 | |||||||

| MRPYRC033 | 764,919 | 964,718 | 356 | 70 | -61 | 66 | 26 | 29 | 3 | 1.34 |

| MRPYRC034 | 764,934 | 964,736 | 356 | 75 | -60 | 30 | No Significant Intercept | |||

| MRPYRC035 | 764,914 | 964,732 | 356 | 75 | -60 | 40 | 16 | 27 | 11 | 1.07 |

| MRPYRC036 | 764,891 | 964,725 | 355 | 75 | -60 | 60 | 35 | 42 | 7 | 2.24 |

| MRPYRC037 | 764,867 | 964,719 | 358 | 75 | -59 | 87 | No Significant Intercept | |||

| MRPYRC038 | 764,916 | 964,764 | 357 | 75 | -60 | 30 | 10 | 17 | 7 | 2.95 |

| MRPYRC039 | 764,894 | 964,758 | 356 | 75 | -59 | 48 | 28 | 31 | 3 | 15.51 |

| MRPYRC040 | 764,872 | 964,752 | 357 | 75 | -60 | 95 | No Significant Intercept | |||

| MRPYRC041 | 764,960 | 964,685 | 354 | 0 | -59 | 30 | No Significant Intercept | |||

| MRPYRC042 | 764,962 | 964,633 | 353 | 0 | -59 | 66 | No Significant Intercept | |||

| MRPYRC043 | 764,981 | 964,631 | 353 | 0 | -59 | 73 | 37 | 48 | 11 | 0.94 |

| MRPYRC049 | 765,037 | 964,627 | 352 | 0 | -60 | 58 | 35 | 39 | 4 | 8.31 |

| MRPYRC050 | 765,020 | 964,627 | 351 | 0 | -59 | 48 | 36 | 45 | 9 | 0.94 |